Most business owners use their own personal bank accounts for their business needs. However, these accounts are for personal use, and mixing it up with business transactions isn’t ideal. As your business grows, your cash transactions (both inflows and outflows) will grow as well. To manage your cash flow efficiently, you will need the right deposit system in place.

Majority of banks offer various deposit accounts that will suit your business needs. Use the steps below can guide you:

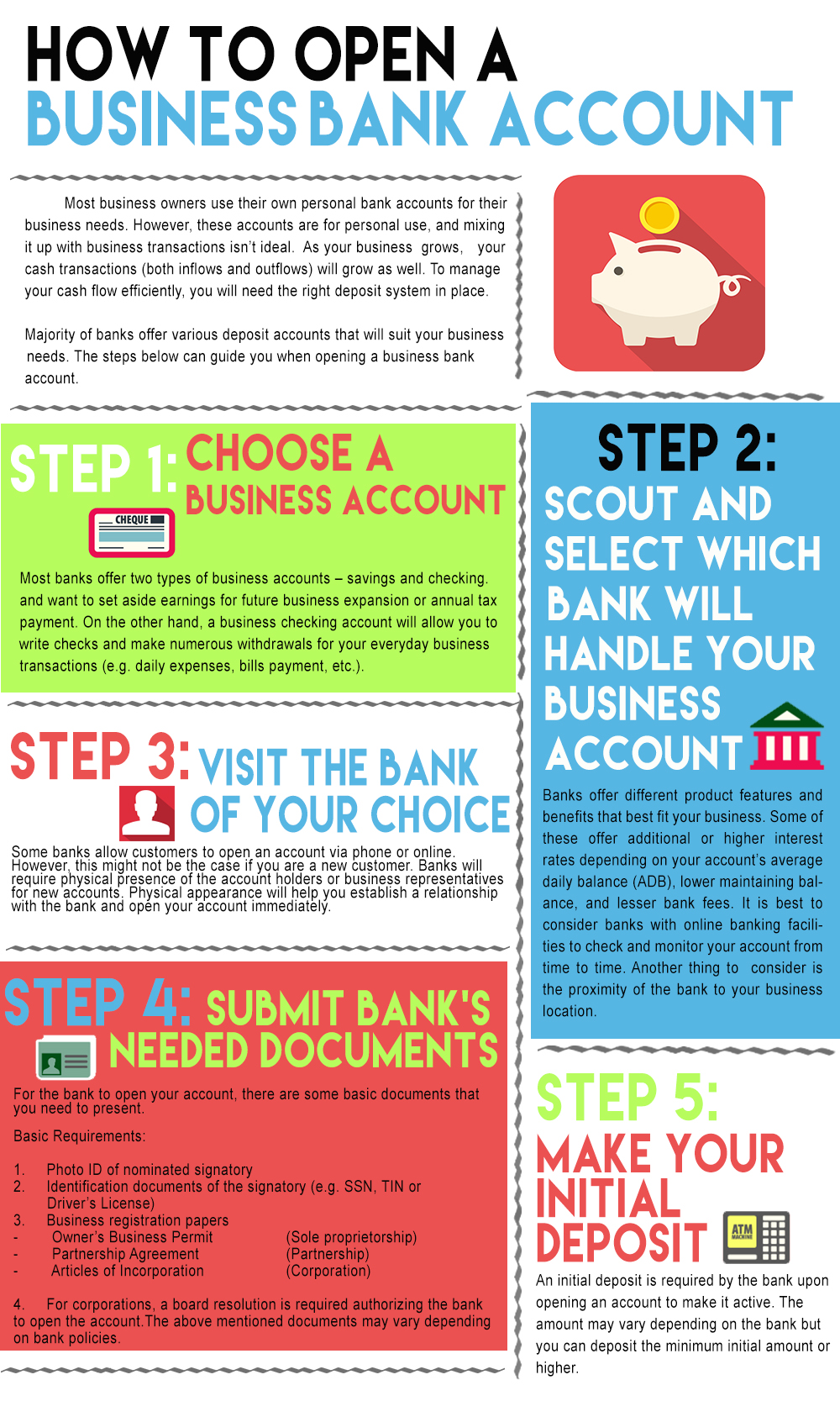

Step 1: Choose a business account

Most banks offer two types of business accounts – savings and checking. Business savings account may be best for you if you have less withdrawals and want to set aside earnings for future business expansion or annual tax payment. On the other hand, a business checking account will allow you to write checks and make numerous withdrawals for your everyday business transactions (e.g. daily expenses, bills payment, etc.).

Step 2: Scout and select which bank will handle your business account

Banks offer different product features and benefits that best fit your business. Some of these offer additional or higher interest rates depending on your account’s average daily balance (ADB), lower maintaining balance, and lesser bank fees. It is best to consider banks with online banking facilities to check and monitor your account from time to time. Another thing to consider is the proximity of the bank to your business location.

Step 3: Visit the bank of your choice

Some banks allow customers to open an account via phone or online. However, this might not be the case if you are a new customer. Banks will require physical presence of the account holders or business representatives for new accounts. Physical appearance will help you establish a relationship with the bank and open your account immediately.

Step 4: Submit bank’s needed documents

For the bank to open your account, there are some basic documents that you need to present.

1. Photo ID of nominated signatory

2. Identification documents of the signatory (e.g. SSN, TIN or Driver’s License)

3. Business registration papers

– Owner’s Business Permit (Sole proprietorship)

– Partnership Agreement (Partnership)

– Articles of Incorporation (Corporation)

4. For corporations, a board resolution is required authorizing the bank to open the account.

The above mentioned documents may vary depending on bank policies.

Step 5: Make your initial deposit

An initial deposit is required by the bank upon opening an account to make it active. The amount may vary depending on the bank but you can deposit the minimum initial amount or higher.

Small Business Bank Account

Nowadays, it’s best to open a business account in a flexible and dependable bank that embraces innovation because of the going all-digital and fast-paced business arena. That’s why it’s crucial to choose a bank that can help improve the visibility of your business and manage your finances seamlessly.

If you want to open an account without hassle, banks like Monzo offer a free business bank account, helping small business owners remain on top of their finances. By doing so, you can easily keep track of what you’re spending and when they’re paid right away to be on top of your finances.

Here are the important things you have to know when opening a small business bank account:

- Consider Accounting Automation: It’s good to choose a bank that can provide solutions, such as integrating your existing accounting system into your banking with automation. It means that you can automatically share transactions and balances daily to authorized users and easily export and process files for accounting purposes.

- Check Tax Process Assistance: This feature can help you automatically set a profit percentage towards your taxes, so the amount is neatly separated into one bank account. In this way, you don’t need to worry about saving, allowing you to spend more time managing your business.

- Test Customer Service: It’s best to work with a bank that doesn’t require making an appointment or going to branches to sort things out. With mobile banking, everything can be managed online in just a few taps.

- Check the Features: The best features of mobile banking solutions include digital receipts, managed scheduled payments, instant notifications, and advanced security.

Conclusion

Now, you’re more knowledgeable about opening a business bank account. Whether you’re a small business owner who has an online store or small shop in your local area, or managing a big company, opening a business bank account should be carefully thought off so that you can choose the best partner bank for your business.