7 Financing Methods to choose from when starting a business

Everything you see now was once imagined. When we talk about rich people we directly think everything was laid out for them or they were born with a silver spoon in mouth. But did you know that out of 100 richest people in the US, only 27 are heirs and the rest (73) are self-made?(source: bloomberg.com)

It tells us that its not what you have, but what you make out of what you have that will determine the course of your life. Money begets money. We all know that jumpstarting any venture requires that you have a stash of fund to keep your business up and running. Your finances can tweak the direction of your business and you must assess all the possible measures before you put yourself at stake.

7 ways of how you can fund you startups.

In your initial planning and consideration, I would like to walk you through the

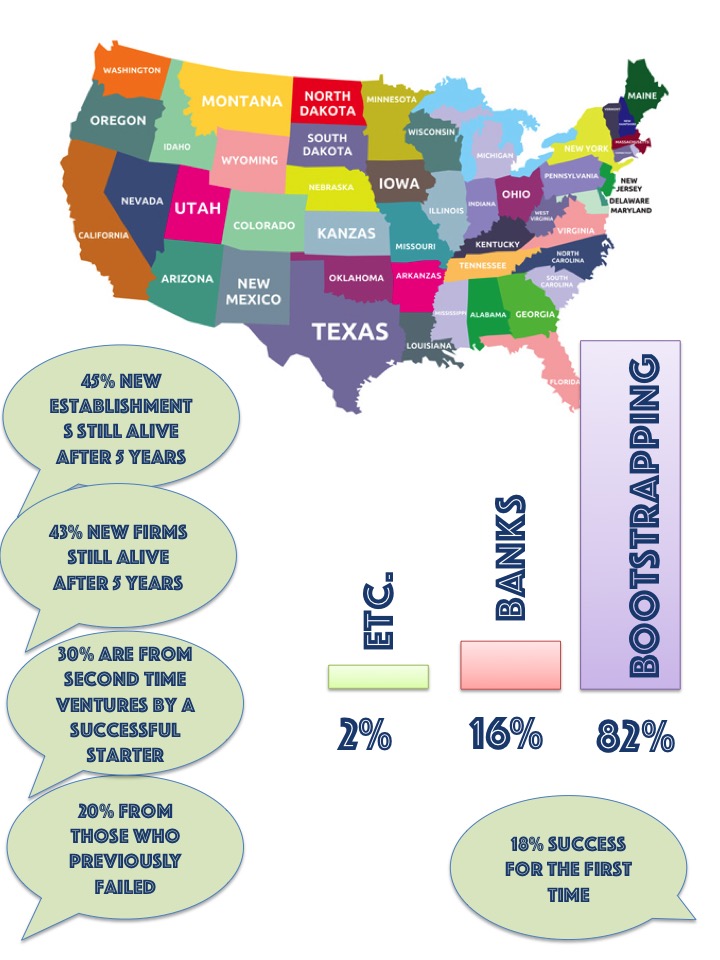

1. “Bootstrapping”: Is a self- sustaining process without external help through internal cash flow.

It’s tapping into your personal savings, taking from your 401K or using personal credit cards to buy the initials and cover the set up costs. In simpler terms, it means you are on your own.

It’s tapping into your personal savings, taking from your 401K or using personal credit cards to buy the initials and cover the set up costs. In simpler terms, it means you are on your own.

UPSIDE

• The owner maintains control, this will give them time to focus on customers instead of investors.

• This will teach the starters the discipline in their expenditures.

• Forces them to rely on their own capacity.

• No risk for debt

CAUTION

• Keep an emergency fund

• Since you are your own resource, you’re also responsible for the outcome.

E.g. Coca-Cola, Apple Computer are some of the companies who started with a bootstrap method.

2.”Crowdfunding” – This is the practice of raising financial contributions from a large number of people without giving up equity.

This model is fueled by 3 main personas: the PROJECT INITIATOR [who proposes the idea], INDIVIDUALS/GROUP who support the idea, and MODERATING ORGANIZATION [the platform] that brings the 2 parties to launch the idea. It’s the fastest growing means of financing method in the US. Due to its popularity, more campaigns are launched globally on a daily basis.

This model is fueled by 3 main personas: the PROJECT INITIATOR [who proposes the idea], INDIVIDUALS/GROUP who support the idea, and MODERATING ORGANIZATION [the platform] that brings the 2 parties to launch the idea. It’s the fastest growing means of financing method in the US. Due to its popularity, more campaigns are launched globally on a daily basis.

UPSIDE

• For most creative works, this method works at best. Entrepreneurs embrace this readily for the reason of simplicity and minimal risks. You are engaging with the audience for feedback + marketing your products altogether. Talk about hitting 2 birds with 1 stone.

• Great option for SMB, most platforms fund “special” projects.

• They like to kickstart promising ventures that would sure skyrocket in the market one day.

CAUTION

• You must develop a very viable business plan to pitch them. It will take time execute the campaign so it will slow down your timeline.

• You will need a legal advise and a PPM [private placement memorandum]

E.g. Indiegogo, crowdfunder, rockethub are some of the famous personas.

Pebble Watch the most famous and highest grossing crowdfunding campaign that hit the market.

3. “Friends & Family”: You know what they say, “It all starts in the family”.

This is a bit self-explanatory. Basically, you get a lend from your circles of trust with a good heart and faith that you will succeed in your venture. FYI: 38% of startups get funds from friends and families. Goes to show that “Family” is always the first go-to shop.

UPSIDE

• You get the support of your trusted individuals.

• Mostly, they won’t demand a timeline for return payments.

CAUTION

• Don’t just ask for personal favors. Put it in paper so that everyone clearly knows what they’re in for.

• You specify the arrangement such as interests, equity, duration for payment etc.

4.”Guaranteed Loans”: They are the traditional lenders such as bank and credit.

Although this may entail a thorough background checking and procedures, its another classic go-to for starters. This means if the borrower defaults, it makes the guarantor liable for the debts in case of bankruptcy depending on the agreement. Guarantor is usually a family or relative.

UPSIDE

* (SBA) Small Business Administration – a United States Government agency that supports entrepreneurs with a mission to maintain and strengthen American economy. They provide government-backed guarantee on part of the loan.

• The numbers of approved start-up loans have increased by 31% on 2014

• In 2014, approximately there are 9,826 approved loans. [3.25mil$] for SMB startups

• Banks are lenders not investors. You need to be credible in order to gain their trust.

• It comes with fees and huge interest charge from left to right to compensate the high-risk nature of loans.

5.”Angel Investors”: They are accredited investors with the legal ownership equity.

Also referred as informal investors mostly with the determination for ownership equity or convertible debt. They can be a pool of individuals forming an organization or individual pursuits.

UPSIDE

• They favor huge and competent companies. The more employees the better.

• These angels can pursue investments for philanthropic reasons or pure mentoring.

• Most investors use their personal funds not as a group capital fund.

CAUTION

• They set high expectations for returns within a short period of time.

• It’s recommended to ask for professional help of accounting firms and lawyers for diligent preparation.

E.g. Silicon Valley, Mark Cuban as owner of NBA’s Dallas Mavericks are some of them.

6.”Incubators”: Solely dedicated for startups. They focus on research and business consultations for early-stage companies.

But they have the luxury to select their clients. This method is good for your networking activities and if you need assistance in terms of marketing & PR, management of intellectual property and strategic partners in the future. Fostering entrepreneurial climate.

UPSIDE

• Although its only famous on developed countries, its starting to expand with the help of UNIDO and the World Bank for underdeveloped countries to raise interest on international grounds.

• They offer investment capitals and support staff to help you in all aspects of your business.

CAUTION

• They are not required by law to offer assistance in contrast to SBA. But they do team up with SBDC’s [Small Business Development Centers] to meet prospect clients.

• Because they have a vested interest in your company, they demand to be involved in all the decisions you will partake. There’s always the possibility for clashing of opinions.

E.g. Boston’s Cambridge Innovation Center, Washington, D.C.’s 1776,

7.”Venture Capitalist”: They are firms who invest initial or growth capital for equity.

They also provide with specialists to guide and ensure that their investments will yield returns which could be helpful if your business experience is challenged. They earn by owning a certain share/stake in the company they have invested in. And because they cash in on high risk for “amateur companies” they have significant control over the matters concerning the heart of the business. They account for 2% of US GDP and a barometer for innovative measures. They usually go for in-demand products with the potential for rapid growth ensuring secured profit.

UPSIDE

• More formal approach than angel investments

• Focus not only on startups but also additional growth

• Mostly they invest in INFORMATION & DIGITAL TECHNOLOGY

• They also provide with specialists to guide and ensure that their investments will yield returns, which could be helpful if your business experience is challenged.

CAUTION

* Same as incubators, they would want a say in your ventures. They can add members of their own and may control the derivatives of your business.

E.g. Rockefeller family, Silicon Valley, Jim Goetz of Sequoia Capital

Find out what works for you and do it!

sources:[businessweek.com, forbes.com inc.com]