Thinking of starting a business in the Philippines? One way to do this is to organize and register a Philippine corporation.

What is a corporation?

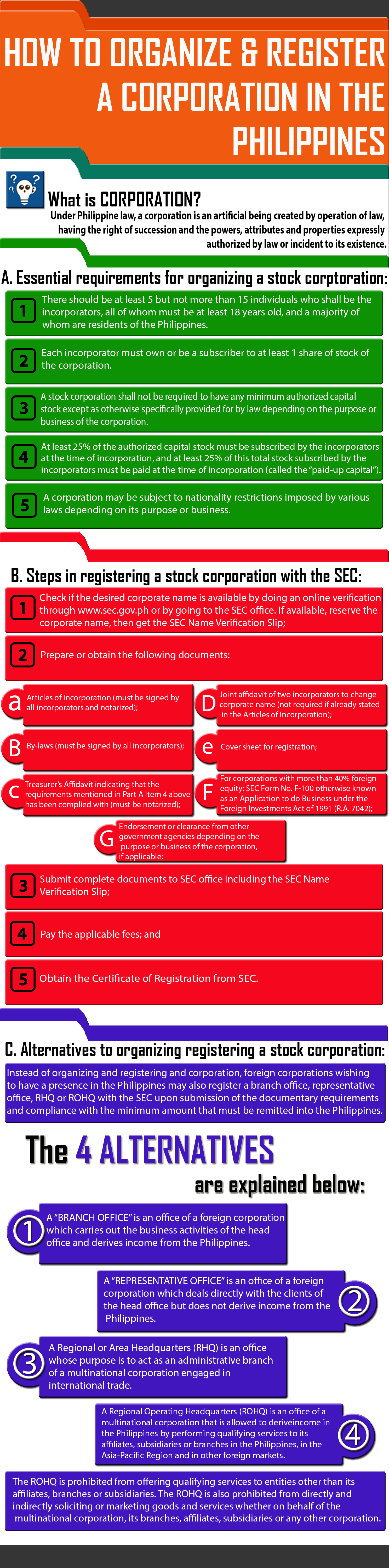

Under Philippine law, a corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence.1

Corporations may be classified as either stock or non-stock corporations. Stock corporations have capital stock divided into shares of stock (called the “authorized capital stock”) which may be issued to the stockholders. Stock corporations are allowed to distribute to the stockholders dividends on the basis of the amount of shares of stock owned by them. All other corporations are non-stock corporations.2

A stock corporation is the appropriate type of corporation for the purpose of operating a business.

In general, corporations organized in accordance with Philippine law are registered with the Philippine Securities and Exchange Commission (SEC).

A corporation has a life of 50 years from the date of registration with the SEC, unless sooner dissolved or unless said period is extended.3

Below are the requirements for, steps in, and alternatives to organizing and registering a stock corporation:

A. Essential requirements for organizing a stock corporation:

1. There should be at least 5 but not more than 15 individuals who shall be the incorporators, all of whom must be at least 18 years old, and a majority of whom are residents of the Philippines.4

2. Each incorporator must own or be a subscriber to at least 1 share of stock of the corporation.5

3. A stock corporation shall not be required to have any minimum authorized capital stock except as otherwise specifically provided for by law depending on the purpose or business of the corporation.6

4. At least 25% of the authorized capital stock must be subscribed by the incorporators (i.e., issued to the incorporators) at the time of incorporation, and at least 25% of this total stock subscribed by the incorporators must be paid at the time of incorporation (called the “paid-up capital”).

Generally, the paid-up capital at the time of incorporation should not be less than Php 5,000.7 However, higher amounts of paid-up capital may be required by law. A list of the industries requiring a higher paid-up capital may be seen at www.sec.gov.ph.

5. A corporation may be subject to nationality restrictions imposed by various laws depending on its purpose or business. For example, at least 60% of the shares of stock of a corporation which owns land must be held by citizens of the Philippines.8

For a list of the industries that are subject to nationality restrictions, the most recent Foreign Investment Negative List may be downloaded at www.gov.ph.

B. Steps in registering a stock corporation with the SEC:

1. Check if the desired corporate name is available by doing an online verification through www.sec.gov.ph or by going to the SEC office. If available, reserve the corporate name, then get the SEC Name Verification Slip;

2. Prepare or obtain the following documents:

b. By-laws (must be signed by all incorporators);

c. Treasurer’s Affidavit indicating that the requirements mentioned in Part A Item 4 above has been complied with (must be notarized);

d. Joint affidavit of two incorporators to change corporate name (not required if already stated in the Articles of Incorporation);

e. Cover sheet for registration;

f. For corporations with more than 40% foreign equity: SEC Form No. F-100 otherwise known as an Application to do Business under the Foreign Investments Act of 1991 (R.A. 7042);

g. Endorsement or clearance from other government agencies depending on the purpose or business of the corporation, if applicable;

3. Submit complete documents to SEC office including the SEC Name Verification Slip;

4. Pay the applicable fees; and

5. Obtain the Certificate of Registration from SEC.

The documents identified in Part B Item 2 (a) to (f) may be downloaded from www.sec.gov.ph, obtained from the SEC office, or drafted by professional consultants and advisors.

A list of businesses requiring endorsement or clearance from other government agencies as described in Part B Item 2 (g) may be seen at www.sec.gov.ph.

It should be noted that there are additional documentary requirements to be submitted if the incorporators’ payment for their subscription (i.e., shares of stock) is other than cash, such as land, building, machinery, shares of stock and other types of payment in kind.

C. Alternatives to organizing registering a stock corporation:

Instead of organizing and registering and corporation, foreign corporations wishing to have a presence in the Philippines may also register a branch office, representative office, RHQ or ROHQ with the SEC upon submission of the documentary requirements and compliance with the minimum amount that must be remitted into the Philippines.

Unlike a Philippine corporation, these alternatives are mere extensions of the foreign corporation or multinational corporation and do not exist separately therefrom.

The 4 alternatives are explained below:

2. A “representative office” is an office of a foreign corporation which deals directly with the clients of the head office but does not derive income from the Philippines.

The representative office is fully subsidized by its head office, performing activities such as information dissemination and promotion of the foreign corporation’s products as well as quality control of products;10

3. A Regional or Area Headquarters (RHQ) is an office whose purpose is to act as an administrative branch of a multinational corporation engaged in international trade.

The RHQ principally serves as a supervision, communications and coordination center for its subsidiaries, branches or affiliates in the Asia-Pacific Region and other foreign markets. The RHQ is not allowed to earn or derive income in the Philippines.11

4. A Regional Operating Headquarters (ROHQ) is an office of a multinational corporation that is allowed to derive income in the Philippines by performing qualifying services to its affiliates, subsidiaries or branches in the Philippines, in the Asia-Pacific Region and in other foreign markets.

The ROHQ is prohibited from offering qualifying services to entities other than its affiliates, branches or subsidiaries. The ROHQ is also prohibited from directly and indirectly soliciting or marketing goods and services whether on behalf of the multinational corporation, its branches, affiliates, subsidiaries or any other corporation.12

– General administration and planning;

– Business planning and coordination;

– Sourcing/procurement of raw materials and components;

– Corporate finance advisory services;

– Marketing control and sales promotion;

– Training and personnel management;

– Logistics services;

– Research and development services, and product development;

– Technical support and maintenance;

– Data processing and communication; and

– Business development.

Below are the minimum amounts that must be remitted into the Philippines:

| Foreign Branch Office | |

| – Domestic Market Enterprise | US$ 200,000.00 |

| – Export Market Enterprise | Php 5,000.00 |

| Foreign Representative Office | US$ 30,000.00 |

| Regional Area Headquarters (RHQ) | US$ 50,000.00 (annually) |

| Regional Operating Headquarters (ROHQ) | US$ 200,000.00 |

Bibliography:

1 Section 2, Batas Pambansa Bilang 68, otherwise known as The Corporation Code of the Philippines.

2 Section 3, Ibid.

3Section 11, Ibid.

4Section 10, Ibid.

5 Ibid.

6Section 12, Ibid

7 Section 13, Ibid.

8Section 7, Article XII, Philippine Constitution.

9Section 1(c), Rule I, Implementing Rules and Regulation of Republic Act No. 7042 otherwise known as the Foreign Investments Act of 1991.

10 Ibid.

11 Section 3, Republic Act No. 8756, otherwise known as An Act Providing For The Terms, Conditions And Licensing Requirements Of Regional Or Area Headquarters, Regional Operating Headquarters, And Regional Warehouses Of Multinational Companies, Amending For The Purpose Certain Provisions Of Executive Order No. 226, Otherwise Known As The Omnibus Investments Code Of 1987.

12 Section 4, Ibid.