Did you know that between two and five percent of the global GDP is estimated to be laundered per year? This amounts to somewhere between $800 billion and $2 trillion US dollars every 12 months!

Money laundering is an illegal process that involves making significant amounts of money via criminal activity, such as terrorist funding or drug tracking. The money from the criminal activity is considered dirty, so launderers use a process to make it appear clean.

Money laundering is a serious financial crime, and the last thing you want to do is end up facilitating it unintentionally. This is why businesses need to have anti money laundering policies in place to detect and stop this activity.

One of the best ways to prevent money laundering is to implement money laundering software. But with so many options to select from, it can be difficult to know which tool to use. Don’t panic, though, as we have made it easier for you. Here are the three best tools on the market today:

- SEON

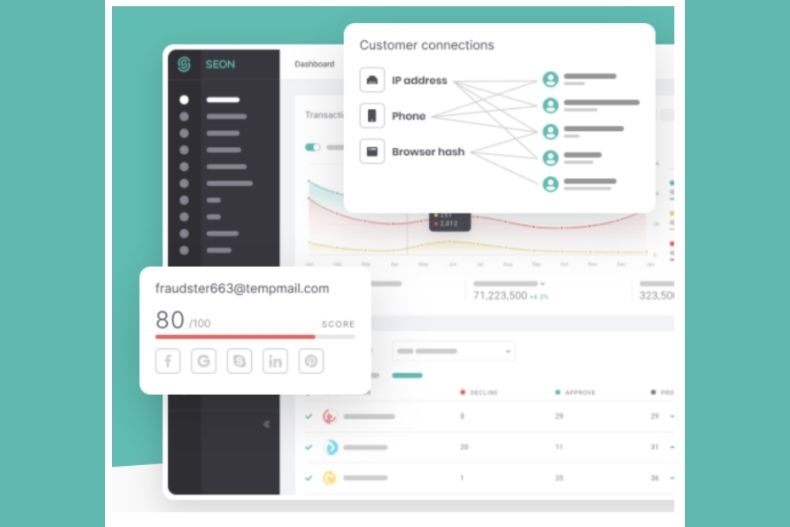

There is only one place to begin with AML solutions, and this is with SEON, which is a full fraud prevention tool.

With this solution, you can expect advanced behavioral analytics, which you can use to monitor user actions based on velocity rules that can flag suspicious behavior that could indicate money laundering, particularly when looking at combined transaction volume.

You can also expect real-time alerts so that you never miss a high-volume transaction that pops up unexpectedly. The software can calculate the sum of transactions to make sure any combined payments that exceed $2500 are flagged automatically for anti money laundering purposes.

- AMLCheck

Based in Madrid, AMLCheck specializes in automatic and manual checks of user data against PEP lists and sanctions. These lists are provided by Dow Jones Risk & Compliance, their chief partner, and the lists are regularly updated. You can also check against any private or public list you have access to.

In addition to this, you are able to run the same data through risk scores as part of a KYC process based on the 4th EU Anti-Money Laundering and Terrorist Financing Directive.

If your business is based in Europe or you sell to this part of the world, this is a good solution to consider. You can also integrate AMLCheck into your own system directly, which is always an added benefit.

- SumSub

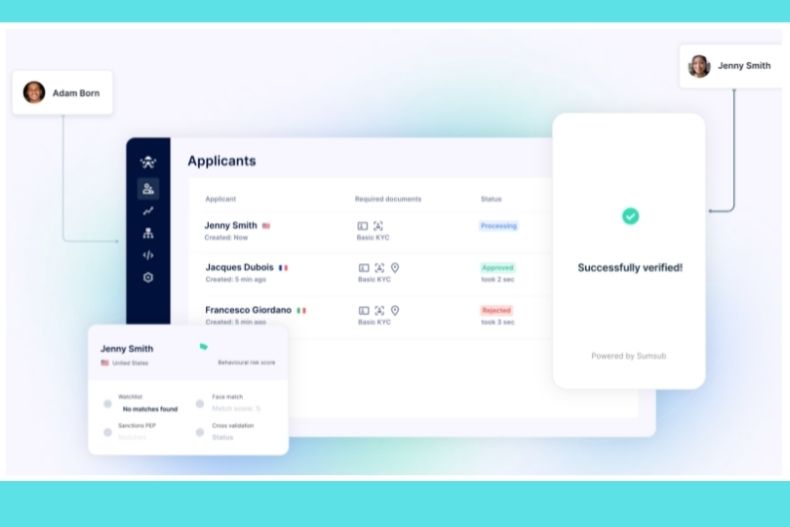

Last but not least, we have SumSub. What makes this platform unique is that SumSub is one of the rare businesses that provide both legal advice, as well as the solution needed to implement improved compliance at your business.

This tool is designed to enhance your risk mitigation approach, particularly with regard to observing the compliance guidelines and regulations that are in place. To achieve this, the software provides robust and powerful tools for checking databases along with 5M articles in 200 countries for any adverse coverage on the media.

The company counts the likes of Flippa, BlaBlaCar, and Hyundai as their clients, among several others. In terms of features, you can expect all of the adverse media checks, PEPs, watchlists, and document verification that your business could possibly require.

Other options to consider

The tools mentioned are three of the best on the market today when it comes to anti money laundering protection. If you find that they are not suitable for you, some of the other options to consider include:

- Token of Trust

- Refinitiv World

- Ondato

- OFAC

- MemberCheck

- iComply

- Feedzai

- Actico

All of the tools mentioned come with advanced features that can help you to protect your business and ensure that it is not used as a platform for criminal activity.

Final words on anti-money laundering software

Anti-money laundering is something all businesses need to take seriously when it comes to protecting their customers and the integrity of their brand.

To prevent money laundering, you need to have a robust strategy in place, as well as an efficient anti money laundering tool.

If you use one of the solutions we have suggested above, you can be sure of an effective anti money laundering tool that will help your business to fight back against this trial.