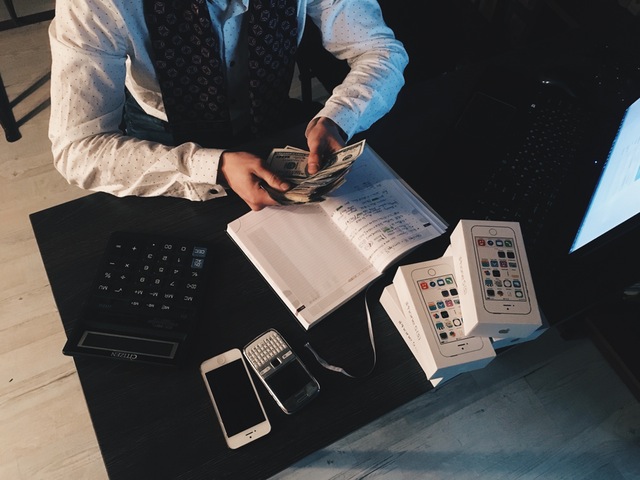

Entrepreneurs who want to start their own business, or those wanting to expand their existing business would often need some external finance to fund their venture. Lack of fund is a big trouble for every business and in this regards, you need some lenders who can finance your business and help you to expand your company venture. It does not matter whether you are running a big or small concern or the nature of your business, as you need to avail these commercial financing loans from the banks and the private lenders by convincing them with your authentic papers.

Why do you need finance for business?

Finance for business is provided for many reasons, and you need to explain your needs to the lenders with your business papers and plans. When you apply for the finance for business, you need to prepare a complete layout of your extension or business plans. In this report, you have to include the purpose of loans, repayment schedules and your business revenue earned in the last few years. It is a statement of purpose where you need to show your repayment capacity and business strength.

- If you have a plan for extending your business and if you want to purchase a new land then you can apply for the business loan.

- Lenders can also finance your business for purchasing new equipments, renting a new office premise and for upgrading your machinery tools.

- Lenders can also provide you with loans for paying wages and for clearing your past debts. If you have taken some loans at a high rate of interest, and you need to foreclose the existing loans then also you can apply for this business loan.

Types of finances available for your business:

When you want to apply for a business loan, the lenders will ask you about your other secured or unsecured loans. If you take a secured loan then you can avail maximum amount at a low interest rate. This is a collateral loan where you need to mortgage your property papers or other assets to the lenders. They will disburse the loan as per the value of your property, and they will charge you with minimum interest amount. Along with that, you can avail this loan within a short period, and you do not need to go for any long term processing.

Unsecured loan can be provided without any collateral base, and they can provide you a stipulated amount on the basis of your business revenue. In this regards, the lender will check your credit report, previous income or income tax certificate, residence and identification proof and they will calculate your existing loan amount also. This loan is provided for short term tenure and you need to pay higher rate of interest for this unsecured loan.

You can also apply for overdraft facility from the banks:

Apart from that, you can also avail the overdraft facility from the banks and lenders. If you have an existing business and you need a small amount for your business expansion, or for clearing your debts then you can apply for overdraft financing from the banks. This loan or finance for your business shall be provided by your bankers only, and you need to maintain your business account in the respective banks. They will provide you a certain amount in your account and you can withdraw the amount partly. The bank will charge you the interest on your withdrawal amount only.

Credit report is very important for your business finance and you need to maintain a good credit report by repaying your existing loan on time. If you have a good credit report then you can easily avail the business loan from any lender at the lowest interest rate.