The US Congress passed several measures to help small businesses during the COVID-19 pandemic. This includes tax rebates, tax-filing extensions, modified tax treatment, emergency relief, and business loans. The most significant benefit is the SBA 7(a) Paycheck Protection Program Loan, also known as the coronavirus loan, which small business owners can use to cover payroll costs.

What is the Paycheck Protection Program?

The Paycheck Protection Program (PPP) is a loan authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which allows the Small Business Administration (SBA) to offer loans up to $10 million to small businesses for payroll-related expenses. This program intends to provide US small businesses with eight weeks of cash-flow assistance and is designed to provide a direct incentive for small businesses to keep their workers on the payroll. Further, this program can turn into a grant for businesses because the eligible amount can be forgiven.

The Paycheck Protection Program is offered as a subset of the SBA 7(a) loan program. However, the qualifications are more lenient, which are mostly related to employee counts and business size. The loan offers potential forgiveness, has lower costs, and does not require personal guarantees or collateral.

Paycheck Protection Loan Terms & Features

- Who is it for: All small businesses in the United States that meet SBA’s size standards

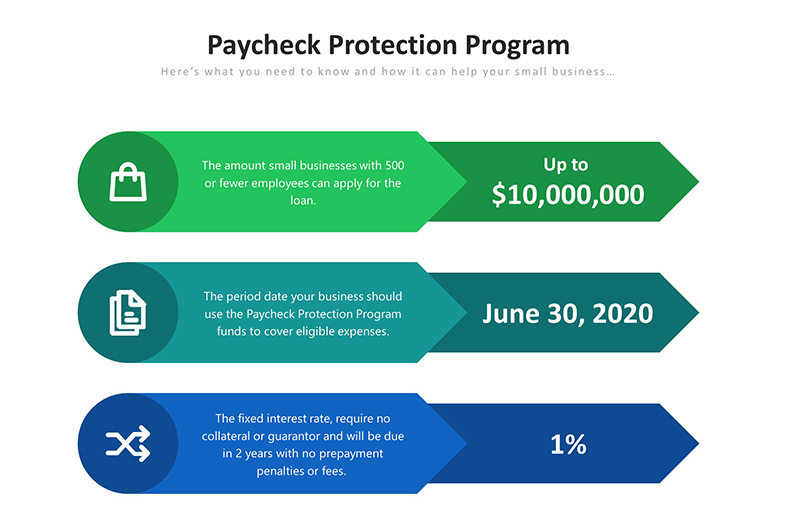

- SBA 7(a) loan amount: Up to $10 million

- SBA Express loan: Up to $1 million

- Repayment Term: Up to 2 years

- Deferral of Payment: 6 months

- Interest Rate: 1%

- Fees: None

- Collateral/Personal Guarantee: Not required

- Loan Forgiveness: The loan can be forgiven and can convert into a non-taxable grant

The maximum amount allowed by the CARES act is $10 million for loans taken under SBA 7(a). SBA Express loan offers quicker funding but the maximum amount is only $1 million. The repayment term is two years, but you don’t need to make monthly payments for the first six months. Forgiveness is available for eight weeks worth of expenses. The amount of forgivable funding can be calculated by estimating payroll costs and other operational expenses.

The CARES act provides a broad definition of payroll. The following costs are considered payroll:

- Salary, wages, commission, or similar compensation (capped at $100,000 on an annualized basis for each employee)

- Cash equivalent for tips

- Vacation, parental, family, and sick leave

- Allowance for dismissal or separation

- Provisions of group healthcare benefits, including insurance premiums

- Retirement benefits

- State or local tax that’s part of employee compensation

- Paycheck Protection Loan Qualifications

Most small businesses, sole proprietorships, independent contractors, and self-employed individuals can all qualify for Paycheck Protection Program loans.

Businesses should meet the following requirements to qualify:

- Be a small business, nonprofit, veterans organization, or tribal business operating as of Feb. 15, 2020

- Employ 500 or fewer employees with a principal place of residence in the United States

- Fit the definition of size standards set by the SBA

- Pay payroll taxes

Submit such documentation as is necessary to establish eligibility, like payroll processor records, payroll tax filings, or Form 1099-MISC, or income and expenses from a sole proprietorship; or other supporting documentation, such as bank records, sufficient to demonstrate the qualifying payroll amount

This program aims to aid in the recovery of specific types of damages small businesses suffer during the COVID-19 crisis. Borrowers should confirm that their business is suffering from one of these issues:

- Supply chain disruptions

- Staffing challenges

- A decline in gross earnings or customers due to the pandemic

- Closure of the business because it’s deemed necessary for public safety

Permitted Uses of Paycheck Protection Loan Funds

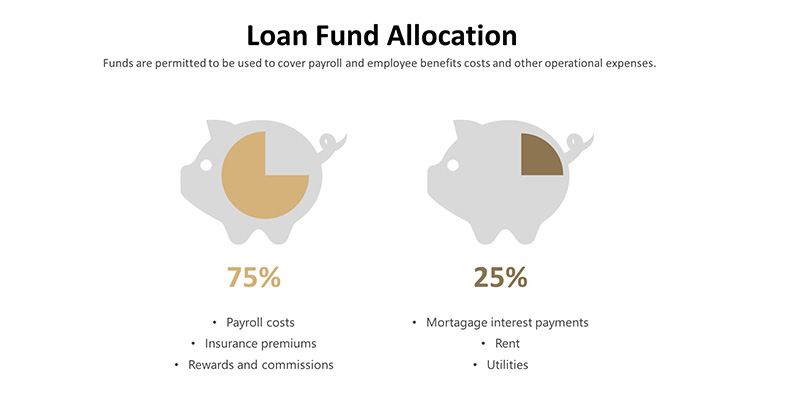

Funds from the Paycheck Protection Program loans should be spent in ways that are allowed by the act to avoid being charged with fraud. Funds are permitted to be used to cover payroll and employee benefits costs and other operational expenses.

75% of the loan funds should be used for the following:

- Payroll costs, like taxes

- Insurance premiums and costs associated with healthcare benefits during periods of paid sick, medical, or family leaves

- Employee salaries, commissions, tips, or similar compensations

25% of the loan funds can be used for the following:

- Mortgage interest payments

- Rent and lease payments

- Utilities

- Interest on debt incurred before the covered period

The Amount of Funding You Can Borrow

The amount of funding you can borrow that will be eligible for forgiveness is your monthly average payroll cost in 2019 multiplied by 2.5 (equivalent to eight weeks), up to a maximum of $10 million. For seasonal businesses, the lender will calculate the average total monthly payroll for a 12-week period from February 15, 2019 to June 30, 2019, and multiply by 2.5. If your business did not exist before June 30, 2019, the lender will calculate monthly expenses from January 1, 2020, to February 29, 2020, and multiply by 2.5.

How to Apply for Paycheck Protection Program Loans

The Paycheck Protection Program loans are backed by the Small Business Administration, however, the SBA itself does not lend you the money. Borrowers should apply with eligible SBA lenders.

You will need to prepare the following documents to apply for the Paycheck Protection Program loan:

- IRS Form 940

- IRS Form 941

- Articles of incorporation

- Bylaws or operating agreement

- Color copy of all owners’ identification

- Payroll summary report or employee pay stubs

- Recent filing of IRS Form 1099-MISC

- Trailing 12-month profit and loss statement

- Recent business mortgage or rent statements

- Recent business utility bills

As part of the application process, you will need to confirm that your business suffers from the current economic uncertainty, which makes the loan necessary to support your ongoing operations. Also, you will be asked to confirm that you will use the funds to retain employees and maintain payroll, or to make payments for mortgage, lease, and utilities. Check this Paycheck Protection application form for more information on the requirements.

How to Qualify For Paycheck Protection Program Loan Forgiveness

In the eight weeks following your loan signing date, all expenses (up to $10 million) related to payroll, mortgage interest, rent, and utilities can be eligible for loan forgiveness. You need the submit the following documents to verify loan forgiveness eligibility:

- Payroll tax filings reported to the IRS

- State income, payroll, and unemployment insurance filings

- Canceled checks, payment receipts, account statements to verify mortgage, lease, and utility obligations

To be eligible for loan forgiveness, it’s essential to keep your records and have accurate bookkeeping of your expenses during the loan period. Your business should use the Paycheck Protection Program funds to cover eligible expenses through June 30, 2020. You should commit to maintaining an average monthly number of full-time equivalent employees equal or above the average monthly number of full-time equivalent employees during the previous one-year period and should spend 75% of the loan funds to cover payroll costs.

The lender will process and account for the portion of the loan used for eligible expenses, and the qualified portion of the loan will be considered canceled debt, making it essentially a grant for the business.

Ideally, small businesses should borrow just enough amount within the parameters of loan forgiveness eligibility. However, you also have the option to borrow more than the amount that can be forgiven and take advantage of this loan’s low-interest rate. Some businesses find this option necessary to help them pay for certain expenses that are not covered under the program.

The remainder of the loan (after the forgiven portion is deducted) will continue with the interest rate of up to 1%. The repayment term is up to two years from the forgiveness date and SBA will continue to guarantee the loan until it is repaid.

How the Paycheck Protection Program Helps Small Businesses

The primary purpose of the Paycheck Protection Program is to protect your employees’ paychecks. This is a modified SBA 7(a) loan designed to provide relief from the negative impact caused by the coronavirus pandemic for small businesses and their workers.

Small business owners can access up to $10 million through the Paycheck Protection Program loan, and if the funds are used to pay for payroll expenses, the amount could be forgiven. Further, small businesses that need additional funds for other expenses not covered by the Paycheck Protection Program, such as inventory, can take advantage of the low-interest rate offered in this loan program.