Certified payroll is a critical requirement for businesses working on federally funded construction projects. It ensures that workers receive the correct wages and that contractors comply with labor laws. In 2025, staying compliant with Davis-Bacon Act requirements is more crucial than ever due to stricter enforcement and digital reporting updates.

This guide will walk you through:

✅ What certified payroll is and why it matters

✅ Step-by-step instructions for completing a certified payroll report

✅ Common mistakes and how to avoid them

✅ Compliance requirements and penalties for non-compliance

Whether you’re a contractor, subcontractor, or payroll administrator, this guide will help you understand certified payroll and ensure your business remains compliant in 2025.

What Is Certified Payroll?

Certified payroll is a specialized payroll reporting process required for businesses working on federally funded construction projects. It ensures that employees receive the prevailing wage as mandated by the Davis-Bacon Act.

To comply, contractors and subcontractors must submit Form WH-347 weekly to the Department of Labor (DOL) or the relevant contracting agency. This form provides details about:

✅ Employee wages (including base pay and overtime)

✅ Hours worked per project

✅ Payroll deductions (such as taxes and benefits)

✅ Job classifications (to verify compliance with prevailing wages)

Failure to comply can result in hefty penalties, loss of government contracts, and even legal action.

Why Is Certified Payroll Important?

- Protects Workers’ Rights – Ensures fair wages for construction workers.

- Prevents Fraud – Avoids underpayment, wage theft, and payroll manipulation.

- Legal Requirement – Government-funded projects must follow certified payroll laws.

- Ensures Transparency – Creates an auditable record for government oversight.

By 2025, certified payroll compliance has become even more digitally streamlined, with many agencies requiring electronic submission through platforms like SAM.gov.

Understanding the Davis-Bacon Act

The Davis-Bacon Act (DBA) is a federal law enacted in 1931 that ensures workers on federally funded construction projects are paid prevailing wages. This law applies to contracts over $2,000 for the construction, alteration, or repair of public buildings and works.

Key Provisions of the Davis-Bacon Act

✅ Prevailing Wage Requirement – Contractors must pay workers no less than the locally established prevailing wage for their job classification.

✅ Certified Payroll Submission – Employers must submit Form WH-347 weekly to confirm compliance.

✅ Fringe Benefits Inclusion – Employers can meet prevailing wage requirements through direct wages or a combination of wages and fringe benefits (e.g., health insurance, pension contributions, or deferred compensation plans). Learn more about our guide on deferred compensation and how it benefits employees.

✅ Applies to Subcontractors – All subcontractors working under the primary contractor must also comply with certified payroll rules.

✅ Enforcement & Penalties – The U.S. Department of Labor (DOL) enforces compliance. Violations can result in withheld payments, contract termination, fines, or even debarment from future federal projects.

Recent Updates for 2025

The DOL updated the Davis-Bacon Act regulations in 2023, and in 2025, stricter enforcement and digital reporting requirements continue. Key updates include:

🔹 Electronic Reporting Requirement – Many agencies now require digital submission via SAM.gov or other state-specific platforms.

🔹 Higher Wage Rates – Prevailing wages have been recalculated in many states to reflect economic changes.

🔹 Stronger Enforcement – More audits and random compliance checks are expected in 2025.

Who Enforces the Davis-Bacon Act?

The Wage and Hour Division (WHD) of the U.S. Department of Labor is responsible for enforcing the Davis-Bacon Act. Federal contracting agencies also monitor compliance by reviewing certified payroll reports and conducting on-site inspections.

If a contractor violates Davis-Bacon requirements, they may face:

❌ Delayed payments or contract suspension

❌ Fines and penalties

❌ Debarment from future government contracts

Who Needs to Submit Certified Payroll?

Certified payroll applies to contractors and subcontractors working on federally funded construction projects. If your company is performing work on a public works project that receives funding from the federal government (or certain state and local agencies following federal standards), you are required to submit certified payroll reports.

Who Is Required to Comply?

✅ General Contractors – The primary contractor responsible for completing the government contract.

✅ Subcontractors – Any business or individual hired by the general contractor to perform a portion of the work.

✅ Construction Companies – Any company involved in public infrastructure, roads, bridges, schools, and other government-funded projects.

✅ Trade Workers & Laborers – Certified payroll covers all mechanics, electricians, plumbers, carpenters, roofers, painters, and other skilled workers.

Which Projects Require Certified Payroll?

Certified payroll is required for:

✔️ Federal Government Construction Contracts over $2,000

✔️ State or Local Projects Receiving Federal Funds

✔️ Public Infrastructure Projects (roads, bridges, highways, schools, hospitals, and government buildings)

✔️ Prevailing Wage Jobs under the Davis-Bacon Act

What Happens If You Don’t Submit Certified Payroll?

Failure to submit certified payroll can lead to:

❌ Delayed Payments – Contractors may not receive payment until reports are submitted.

❌ Fines & Penalties – The DOL can impose significant fines for violations.

❌ Contract Termination – The government may cancel your contract for non-compliance.

❌ Debarment – Contractors who violate certified payroll laws can be banned from future government contracts for up to three years.

How Certified Payroll Works

Certified payroll is a weekly reporting process that ensures contractors and subcontractors on government-funded projects pay workers the correct wages and benefits. The process involves recording detailed payroll data and submitting it using Form WH-347 to the U.S. Department of Labor (DOL) or the contracting agency.

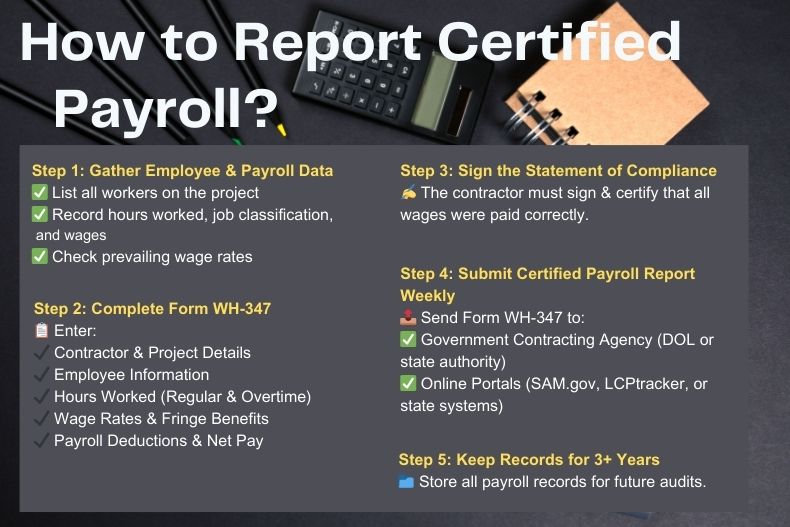

Here’s a step-by-step breakdown of how certified payroll works:

1. Determine If Certified Payroll Applies to Your Project

Before starting a project, verify if it falls under the Davis-Bacon Act or other prevailing wage laws. This typically applies to construction projects over $2,000 that are federally funded.

2. Identify Prevailing Wages for Job Classifications

Prevailing wages vary by:

✅ Location – Wages are set based on regional labor rates.

✅ Job Classification – Each role (e.g., carpenter, electrician) has a specific wage.

✅ Fringe Benefits – Contractors can pay benefits as part of wages or separately.

3. Calculate Wages and Overtime

✅ Pay workers at least the prevailing wage for their classification.

✅ Overtime pay (1.5x the regular rate) applies for hours over 40 per week under the Fair Labor Standards Act (FLSA).

✅ Include fringe benefits, if applicable.

4. Complete Form WH-347 (Certified Payroll Report)

Each week, contractors must submit Form WH-347, which includes:

📌 Employee details (name, last four digits of SSN)

📌 Work classification (e.g., laborer, welder)

📌 Hours worked daily and weekly

📌 Gross wages earned

📌 Deductions (taxes, benefits, etc.)

📌 Net wages paid

📂 Sample WH-347 Form (2025 Edition)

👉 Download the latest Form WH-347 from the DOL website

5. Submit Certified Payroll Reports Weekly

✅ Send Form WH-347 to the contracting agency or Department of Labor.

✅ Some states may require electronic submission through portals like SAM.gov or LCPtracker.

✅ Keep detailed payroll records for at least three years.

6. Maintain Compliance & Avoid Penalties

🚨 Audits and compliance checks are increasing in 2025! Contractors must:

✔️ Ensure accurate wage payments

✔️ Prevent misclassifying employees

✔️ Submit reports on time every week

Key Components of Certified Payroll Reports

1. Contractor and Project Information

At the top of Form WH-347, you must include:

✅ Contractor or Subcontractor Name

✅ Business Address

✅ Project Name and Location

✅ Contract Number (assigned by the government)

✅ Payroll Number (sequential weekly payroll report number)

2. Employee Details

Each worker’s information must be listed, including:

📌 Full Name

📌 Last four digits of Social Security Number

📌 Job Classification (e.g., Carpenter, Electrician, Laborer)

📌 Apprentice or Journeyman Status (if applicable)

3. Hours Worked

The report must accurately record each employee’s hours, including:

🕒 Daily Hours Worked (each day of the week)

🕒 Total Weekly Hours

🕒 Overtime Hours (must be correctly calculated per FLSA rules)

4. Wage Rate and Fringe Benefits

You must specify:

💰 Base Hourly Wage (must meet or exceed prevailing wage rates)

💰 Fringe Benefits Paid (either in wages or through benefit plans)

🔹 Example: If a laborer’s prevailing wage is $30/hour and includes $5/hour in fringe benefits, you can pay $30/hour in wages OR $25/hour in wages + $5/hour in benefits.

5. Deductions and Net Pay

Common deductions include:

❌ Federal and State Taxes

❌ Social Security and Medicare (FICA)

❌ Union Dues (if applicable)

❌ Health Insurance Contributions

After deductions, the report must show the net amount paid to the employee.

6. Certification Statement (Signature Required)

The last section of Form WH-347 requires the contractor to sign under penalty of perjury, verifying that:

✔️ The payroll is accurate and complete

✔️ Employees were paid the correct wages

✔️ No unauthorized deductions were made

🔹 Submitting a false certified payroll report can result in serious legal consequences, including fines and debarment!

👉 View Sample Certified Payroll Report (PDF)

Step-by-Step Guide to Completing a Certified Payroll Report

Step 1: Download Form WH-347

You can get the official form from the Department of Labor website:

👉 Download WH-347 Form (2025 Version)

Step 2: Fill in General Project Information

At the top of the form, enter:

✅ Company Name & Address – Your business name and mailing address.

✅ Project Name & Location – Name and physical address of the construction site.

✅ Contract Number – Found in your federal or state contract paperwork.

✅ Payroll Number – A sequential number for tracking weekly reports (e.g., Payroll #1, #2, etc.).

✅ Week Ending Date – The last workday included in the report (MM/DD/YYYY format).

Step 3: List Employee Information

For each employee working on the project, provide:

📌 Full Name – First and last name.

📌 Last 4 Digits of Social Security Number – (e.g., ***-12-3456).

📌 Job Classification – Must match Davis-Bacon wage classifications (e.g., “Electrician,” “Carpenter”).

📌 Apprentice or Journeyman Status – If applicable, list training status.

🔹 Ensure job titles match the contract’s wage determination list to avoid misclassification penalties!

Step 4: Record Hours Worked

For each employee, enter:

🕒 Daily Hours Worked – Hours worked each day (Monday to Sunday).

🕒 Total Weekly Hours – Sum of all hours worked that week.

🕒 Overtime Hours – Any hours exceeding 40 hours per week must be marked separately.

🔹 Federal law requires overtime to be paid at 1.5x the base hourly rate for any hours over 40 in a workweek.

Step 5: Enter Wage Rate and Fringe Benefits

List each employee’s:

💰 Base Hourly Wage – Must meet or exceed the prevailing wage.

💰 Fringe Benefits Paid – Either included in wages or paid separately.

🔹 Example:

- If an electrician’s prevailing wage is $40/hour, including $8/hour in fringe benefits, you can either:

- Pay $40/hour in wages, or

- Pay $32/hour in wages + $8/hour in fringe benefits.

Step 6: Deduct Taxes and Other Withholdings

List all deductions, including:

❌ Federal & State Income Taxes

❌ Social Security & Medicare (FICA)

❌ Health Insurance Premiums

❌ Union Dues (if applicable)

Finally, enter the net amount paid to each worker after deductions.

Step 7: Sign the Statement of Compliance

At the bottom of the form, the contractor (or payroll officer) must:

✅ Sign and Print Name

✅ Certify that wages were paid correctly

✅ Acknowledge that false reporting is a federal offense

🔹 Submitting a false certified payroll report can lead to severe penalties, including fines, contract termination, and debarment from federal contracts!

Step 8: Submit the Report Weekly

✅ Send completed WH-347 forms weekly to the appropriate agency (Department of Labor, state agency, or contracting authority).

✅ Check if electronic submission is required (many states now use portals like SAM.gov or LCPtracker).

✅ Keep copies of reports for at least 3 years for audits.

Frequently Asked Questions (FAQs)

Do I Need to Submit Certified Payroll if I Only Have a Few Employees?

Yes. If you are working on a government-funded project covered by the Davis-Bacon Act, you must submit certified payroll reports regardless of the number of employees. Even if you are a sole proprietor or have only a small team, you must comply with reporting requirements.

How Long Should Certified Payroll Records Be Kept?

According to federal law, certified payroll records must be kept for at least three years after the project is completed. Some state and local agencies may have longer record retention requirements, so it’s best to check local regulations.

What Happens If I Make a Mistake on My Certified Payroll Report?

If you discover an error on your WH-347 form, you should:

✔️ Correct the mistake immediately and submit an amended payroll report.

✔️ Notify the contracting agency if the mistake affects wages or deductions.

✔️ Keep records of the correction in case of an audit.

Failing to correct errors can result in penalties, withheld payments, or even contract termination, so it’s important to address mistakes as soon as possible.

Final Thoughts

Certified payroll is an essential part of compliance for contractors and subcontractors working on federally funded projects. Understanding and following certified payroll requirements will help you:

✅ Ensure workers are paid correctly under the prevailing wage laws.

✅ Avoid costly penalties and fines due to non-compliance.

✅ Maintain eligibility for future government contracts.

With updated regulations in 2025, digital submission and stricter enforcement make it more important than ever to accurately complete and submit certified payroll reports on time. Using payroll software or compliance tracking tools can help streamline the process and reduce errors.

If you are unsure about any certified payroll requirements, consult a payroll specialist, labor attorney, or your local Department of Labor office for guidance.

By staying compliant, you protect your business, your employees, and your ability to continue working on government-funded projects in the future.