Global Financial Updates

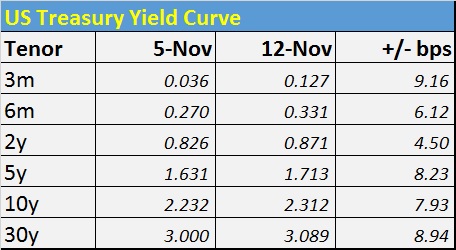

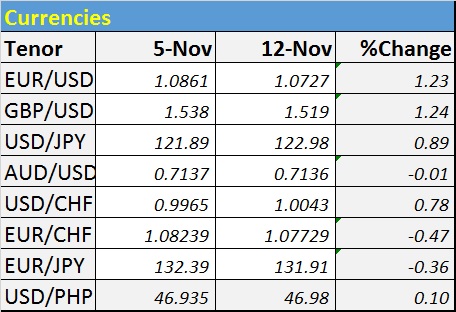

Global equities dropped by over 1 percent compared to the previous week performance as investors are concerned of hawkish statements by FED and weakness in commodities. However, strong US labor data lifted US Treasury yields amid FED statement to increase interest rates before end of month this year. US dollar continues to remain strong compared to EURO.

| 05-NOV-15 | 12-NOV-15 | %Change | |

| MSCI World | 1,704.39 | 1,671.49 | 1.93 |

| MSCI Europe | 128.30 | 125.69 | 2.03 |

| MSCI Asia-Pacific ex-Japan | 506.77 | 517.15 | 2.05 |

| Dow Jones Industrial Average | 17,910.33 | 17,702.22 | 1.16 |

| S&P 500 | 2,099.20 | 2,075.00 | 1.15 |

US

Indices suffered losses week-on-week with investors anticipations of interest rate increase by Fed, lower oil prices, that may affect global growth. A positive and favorable US non-farm payroll data triggered the probability of the December rate hike as pointed out by Fed.

EUROPE

Despite the ECB’s positive outlook and strong corporate earning results, European stocks close the week at low due to lackluster results of some companies, of possible US rate hike, China’s deflation threat.

ASIA

Asian markets continued to suffer its losses for most of the week. Losses were attributed by US financial updates on strong labor data, Fed’s hawkish statements, and OECD (Organization for Economic Cooperation and Development) trimmed down their forecasts on global growth seeing emerging markets weakness.