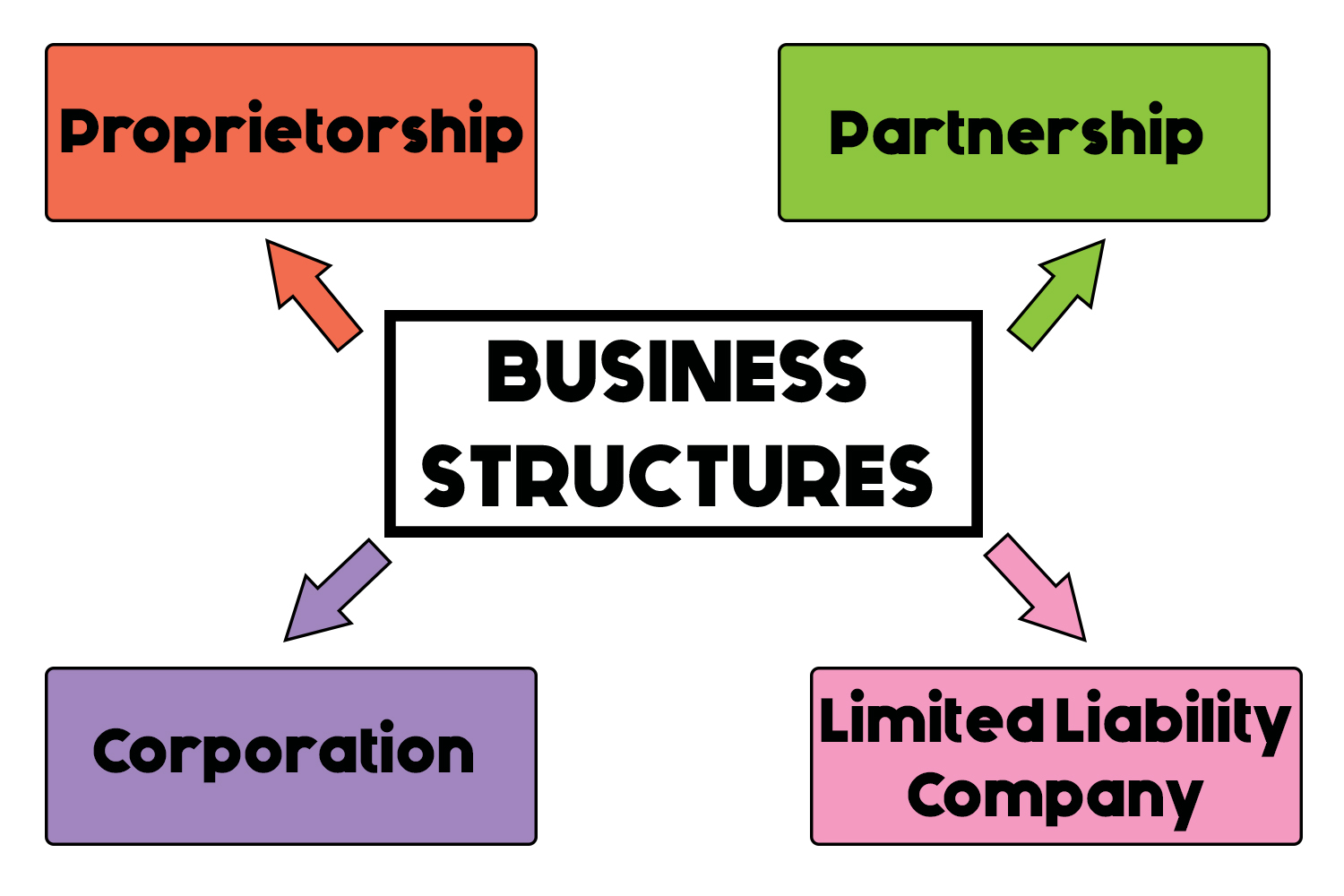

When someone is going to start a law firm, they may wonder how to structure it. They should know there are several options available. Certain things need to be taken into consideration when choosing a law firm structure. This decision will be largely influenced by the jurisdiction where the law firm will operate and the specific set of circumstances a new law firm finds itself. No matter what type of structure is ultimately chosen, it will have certain advantages as well as disadvantages.

Security And Flexibility

Choosing a law firm structure is like any important business decision. All the available options need to be identified. The best possible decision must be made based on all the information relevant to an individual situation. It doesn’t matter what form of legal business structure is chosen, the decision process leading up to that point must be influenced by two competing interests. They are security and flexibility. Security should influence the structure of a law firm by the desire to have it exposed to the lowest level of liability possible. Flexibility is also an important component of a law firm’s structure. It will encourage mobility as well as the growth of a law firm practice. It many ways, security, and flexibility are the opposite of extreme ends. A successful law firm must try and discover the best ways to have the correct balance between both of them. There are common structures for law firms that are important to consider. They should be analyzed to see if they can meet a law firm’s security and flexibility goals.

Sole Proprietorship

Those who want the ultimate in flexibility should consider a sole proprietorship. It is common for a solo legal practitioner to set up their law firm as a sole proprietorship. When a business is managed and owned by one person, it is considered an unincorporated business entity. According to the law, the owner of a sole proprietorship and the business are not separate. This is what provides the flexibility of management. It is considered a significant benefit to the sole proprietor. The owner of a sole proprietorship can set their own hours and choose what area of the law they want to practice. They are in control of their earnings and can determine the clients they want to take on and which ones they feel are best to turn away. A sole proprietorship does have challenges. There could be a limitation on funding sources as well as dealing with an excessive administrative burden. It could require a significant amount of effort to obtain a sufficient number of clients to sustain this type of law practice. A sole proprietor does not have the advantage of being protected by a corporate shield.

Fictitious Or Trade Business Names

Once a law firm has decided to have the structure of a sole proprietorship, they must then determine if they are going to use a fictitious or trade business name. It is common for the name of a sole proprietorship to be the legal name of the person who owns it. Many attorneys want their law practice have a name different from their own. The challenge is to determine if doing this is permissible under the canons of legal ethics. There is also the question of any type of special filing requirements. These are questions that can be answered by a State Bar. In many cases, this is permitted as long as the name is not misleading or deceptive. Any filing requirements will be determined by the jurisdiction where the law firm will be located. It is also advisable to check with the Secretary of State to know if a trade name should be registered and what that process would involve.

General Partnership

This is a popular option for two or more attorneys who want to have a law practice together. A general partnership will be owned by two or more people. Each person will share equally in the liabilities of the partnership as well as the profits. The affairs of the partnership, in theory, should be able to be managed by any of its members. This can become a problem if the members of the partnership have not agreed on the specific roles associated with managing it. This makes it possible for one partner to bind the partnership to a legal obligation without obtaining agreement for it from the other partners. There is also the real possibility of dual taxation that needs to be considered. Many class action law firms use this type of business structure.

Professional Corporation

Should an attorney want their law firm to have a corporate shield, a professional corporation like the Caldwell Wenzel Asthana Law Firm could be the best option. This will be determined by the jurisdiction where the law firm will be operating. It is a type of business that requires a professional license. This means it has a determined separation from its shareholders and owners. To maintain the corporate shield, the corporate formalities must be strictly followed. It is also possible to have an arrangement where a professional corporation could provide the capital advantages associated with a partnership but not the liability and management challenges that go with a partnership. There could be some tax advantages based on how it is structured.

Limited Liability Partnership

This is different from a general partnership. This is because the partnership debt liability is not equally assigned to all the partners. Since this is the case, each partner’s share of the profits is also not the same. In many situations, a limited partnership may be the perfect structure for a law firm. This is especially true if the law practice is starting with several attorneys. A common concern is also the possibility of dual taxation.

Limited Liability Company

Many law firms prefer to use the limited liability structure in their firm. This is attractive because it is considered a hybrid entity. It provides the ability to be as flexible as a sole proprietor and also provide the safety shield associated with a professional corporation. Unfortunately, there are some jurisdictions that don’t permit a law firm to practice using a limited liability structure. This is something important to know before starting the process. Some states require the formation of a limited liability company to be announced. It is often done using a newspaper or other similar publication. Doing this will add some expense to a startup law firm’s budget.

The type of legal structure chosen for a law firm is an important decision. The legal structure will determine the level of taxes as well as if the law firm can be sued for their action or inaction concerning their practice of law and more. All the time necessary should be taken to determine the most effective legal structure based on an individual situation. Speak with a business lawyer as well as an accountant to learn the best possible choice.