Suppose that your sibling asked you for investment advice to plan his retirement. Would you tell him to put 100% of his money in the “hyper-aggressive high-risk appreciation fund?”

Probably not. But that’s exactly what you do when you use your business as your retirement fund.

Consider that the most aggressive mutual funds hold shares in small companies. In the mutual fund world, “small company” means $100 million in sales. Does your business have $100 million in sales? More likely your business has $500,000 or $1 million or maybe $5 million in sales and it is a lot riskier than any investment made by any mutual fund.

In fact, your business is a super high-risk, undiversified asset that has a high probability of extinction.

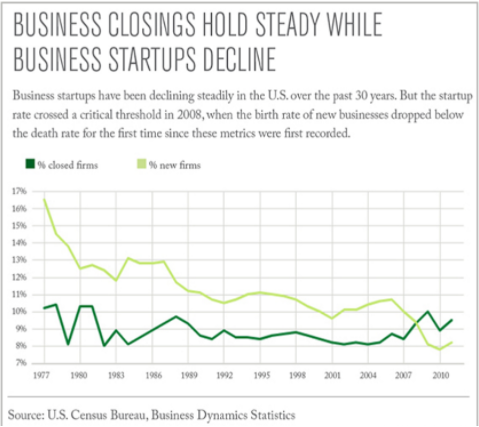

I know your business has been going great and you think it’s the best place to invest your retirement dollars. But your business could turn sour in six months. The Census Bureau says that 400,000 businesses are started each year and 470,000 fail. Many of those failed entrepreneurs were as confident as you about their business and were wrong.

I’m not trying to depress you; I’m trying to tell you not to use your business as your retirement plan. It is far too unpredictable.

This may be easier to see when I share this experience from my years as a financial advisor.

I met many people reaching retirement with the bulk of their 401(k) invested in their company shares. I always told them to immediately diversify. They would always tell me about the greatness of their ex-employer and how the company stock is the best investment in the world. I understand this type of allegiance and pride in their ex-employer.

I recall one of those gentlemen retired from IBM. He had most of his retirement money in IBM shares. I was unsuccessful in my pleadings to diversify.

Here’s the stock price history of IBM in the few years after we met.

I have often thought about him over the years and wondered if he sold or held on. Not many people can tolerate a 50% decline in their retirement account and stay calm or stay the course.

There are two other reasons not to use your business as your retirement plan. Just as doctors should not operate on themselves, you should not manage your own retirement dollars. And since you are the “manager” of your business, your business is not an optimal retirement asset. Even when you agree that you must have a retirement fund separate from your business, have it managed.

Not only do you get another level of skill when you select an expert to manage retirement assets, you distance yourself from short-term emotional reaction. Mistimed emotional reactions have lost far more money for investors than have the markets.

Last, we must consider that entrepreneurs tend to be overconfident and arrogant (not you, the other entrepreneurs). These are disastrous traits when it comes to investing.

A Forbes article states that two important traits for successful investors are patience and humility. When I think of a classic entrepreneurial personality such as Mark Cuban, patience and humility are not words which come to mind. But when I think of a great investor like Warren Buffet, patience and humility fit to a tee. This is yet one more reason your retirement assets should be separate from your business and professionally managed.

Also, consider your family. Your retirement account is not simply for your personal benefit. Having successfully saved for retirement allows for “golden years” with you and your spouse. It also gives your children and grandchildren the opportunity to spend time with you.

So I implore to not use your business as a retirement fund. Do what others do. Get a money manager or mutual fund company, decide on some sensible diversification and then don’t change it. Or buy rental homes. Or invest in assets that have a long term proven record of performance and that does not include your business.