Debt is an unfortunate reality for many small business owners. The average US small business owner carries a staggering small business debt of $195,000. While some amount of debt is normal, excessive liabilities can become major hurdles, severely impacting cash flow, profitability, and long-term growth.

If you feel like debt is dragging your small business down, there’s no need to panic. With strategic planning and proactive small business debt management, overcoming debt hurdles is possible. This post explores practical tips and solutions to assist small business owners in regaining control of their challenging financial situations.

Evaluating Your Current Small Business Debt Situation

Gaining a comprehensive view of existing liabilities is crucial for strategic management. Key aspects to evaluate include

Total Debt Amount

The average small business loan amount is $663,000, providing context on typical debt levels.

To accurately evaluate total debt amount:

- Consolidate balances from all outstanding loans, credit cards, and lines of credit

- Categorize by loan type: long-term, short-term, revolving, etc.

- Calculate interest costs for each debt obligation

- Assess whether the total debt load is manageable or needs reduction

Getting clarity on total debts owed facilitates strategic planning tailored to your business’ capabilities.

Types of Debt

Common financing options include:

- Term Loans: For expansion/refinancing. Requires strong credit and patience.

- SBA Loans: Offer low rates and long repayment terms but extensive approval.

- Credit Cards: Ongoing expenses, rewards programs.

- Lines of Credit: Short-term needs, cash flow management.

Whether it’s term loans, SBA loans, credit card debt, or lines of credit, responsible borrowing involves meticulous planning and vigilance. In cases of financial struggle, seeking assistance through resources like credit counseling and debt consolidation can help regain control and pave the path toward financial stability.

Interest Rates and Terms

- Rates vary based on credit history and collateral.

- Terms dictate repayment timelines.

- Secured debt has lower interest rates.

- Unsecured debt rates tend to be higher.

Secured vs Unsecured Debt

Understanding the differences between secured and unsecured business debt is important for evaluating financing options.

Secured debt:

- Tied to business assets.

- Reduces lender risk.

- Has lower interest rates.

To evaluate secured debt:

- Identify assets owned that can potentially serve as collateral

- Calculate total market value to estimate maximum loan amount

- Research interest rates for secured small business loans

Conversely, unsecured business debt does not require collateral and is extended based on the strength of business performance metrics and credit history. While this allows more flexible financing options, interest rates tend to be higher due to the increased risk for lenders.

Unsecured borrowing may make sense for newer companies with few tangible assets to leverage or smaller financing needs. When assessing unsecured debts a business currently holds, look at the interest rates and compare them to secured alternatives aligned with your risk tolerance.

In summary, assessing both secured and unsecured debts, along with financing options, allows businesses to strategically optimize their capital structure, fostering stability and growth. Profit and loss statements, balance sheets, and cash flow projections help quantify financing costs across debt obligations.

Restructuring Loans and Debts

Once you’ve evaluated your situation, debt restructuring for small businesses can provide relief. This involves negotiating new terms with creditors to make repayment easier.

Two effective approaches include:

- Small business debt consolidation – Consolidating multiple debts into a single, low-interest loan. This simplifies repayment and can significantly lower monthly costs.

- Extending repayment timelines at lower interest rates to free up short-term cash flow.

The goal is restructuring debt in a manageable way that works with your cash flow, providing financial breathing room to operate and eventually eliminate business debt.

Exploring Debt Consolidation Options for Small Businesses

Consolidating business debts into a single loan can greatly simplify small business debt management. Key options to evaluate include:

SBA Loans

Government-backed SBA loans offer affordable interest rates and extended repayment timelines tailored for small business debt relief. Loan amounts reach $5 million.

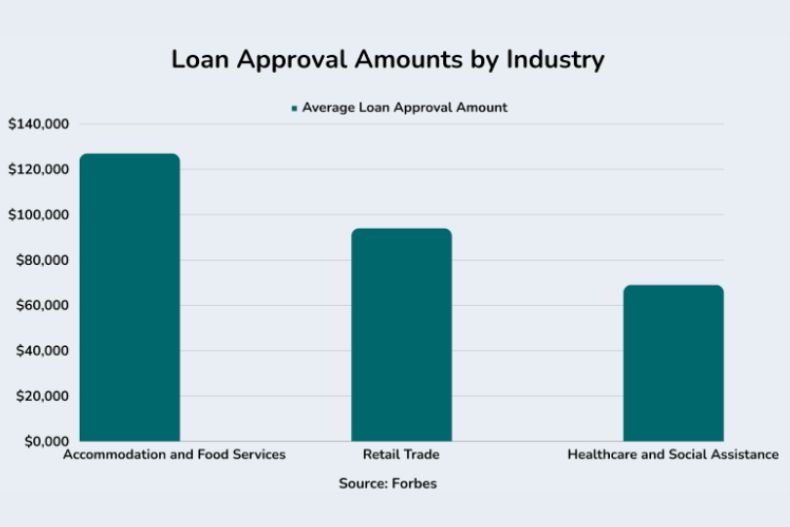

To give you an idea of what businesses in different sectors might expect, let’s look at the average loan approval amounts for the 7(a) program across various industries:

Understanding these figures can assist small business owners in determining the feasibility of securing an SBA loan based on industry benchmarks, aiding informed decision-making for debt consolidation efforts.

Business Cash Advance

These provide a lump-sum cash injection based on future sales, helping urgent capital needs. Approval is faster than traditional loans.

Working Capital Loans

These short-term loans provide funds to cover daily operating costs. Amounts range from $5k – $500k with 3-18 months repayment.

Invoice Factoring

Rather than borrowing, you sell unpaid customer invoices to quickly access capital needed to pay suppliers, etc. This conserves cash flow.

Carefully compare interest rates, fees, eligibility criteria, and overall cost for your situation. Seek guidance from financial advisors for small businesses to determine the optimal debt consolidation solution aligning with your debt repayment capabilities and operating capital requirements.

The goal is proactively structuring finances to enable stability, and growth and focusing on business-building, rather than constantly reacting to cash flow struggles. Consolidating multiple debts through the SBA or other avenues simplifies payment tracking and can save on interest costs over the long term.

Increasing Cash Flow

While restructuring debts offers temporary relief, increasing cash flow tackles the crux of the issue – improving your ability to pay off small business debts without compromising business needs.

Some strategies include

- Cost-cutting by eliminating unnecessary expenses and improving efficiency without affecting quality or workforce morale. For example, negotiating better rates from vendors, optimizing inventory management, switching to more affordable tools, and so on.

- Raising revenue by identifying new income streams, upselling existing customers, improving marketing and sales processes, or launching limited-time promotions. The focus is boosting profitable sales.

- Delaying large purchases for equipment or vehicles by renting or other means until cash flow improves.

Even with marginal gains, you can allocate more toward small business debt repayment until the debts are eliminated.

Assistance Programs for Small Business Debt Relief

You don’t have to tackle debt alone. Government agencies and non-profit organizations offer valuable assistance programs with business debt management.

Government Relief Programs

- The SBA provides useful small business debt relief options including grants, low-interest loans, and payment protection plans.

- State and local governments also offer support programs for qualifying businesses. Research what’s available in your region.

- Many government programs have been expanded due to COVID-19, increasing aid opportunities. Check updated guidelines for eligibility.

Non-Profit Organizations

- Credit counseling services provide free or low-cost financial advice for small businesses struggling with debt.

- Non-profit lenders like Kiva offer crowdfunded small business loans at low-interest rates.

- Grants from organizations like Hello Alice provide debt relief funds that don’t need to be repaid.

Tap into these resources for managing business debt strategically. Every bit of help counts.

Planning Debt Repayment Strategies

With increased cash flow and a debt management plan in place, the next step is mapping out repayment. Two popular methods are the debt snowball and avalanche:

Debt Snowball

- Debts are listed from smallest to largest, regardless of interest rate.

- The smallest debts are paid off completely first before moving up.

- Helps build momentum with small wins.

Debt Avalanche

- Debts are organized by interest rate, from highest to lowest.

- Higher-interest debts are prioritized first.

- Mathematically optimizes interest cost savings.

Choose the method that aligns closest to your small business goals. Create a realistic repayment schedule and focus on sticking to it. Automate payments whenever possible. As debts reduce, allocate a portion towards building an emergency business fund as a buffer against future hurdles.

Increasing Sales Through Targeted Marketing

Targeted marketing plays a pivotal role in attracting new customers and driving sales when tackling business debt. With digital marketing, small businesses can promote their offerings in a strategic, cost-effective manner even with limited budgets.

Research shows that small businesses prioritizing marketing efforts are 1.5 times more likely to achieve revenue growth. Digital marketing specifically helps generate 3 times more leads at a 62% lower cost compared to traditional marketing. Effectively using content marketing further boosts conversion rates by 6 times.

Leveraging data-driven approaches like SEO, social media ads, email nurturing campaigns, and targeted content creation allows businesses to reach their ideal customers. This directly translates to overcoming cash flow struggles.

For example, baking company Whisked Away used social media and content marketing to increase website traffic by 5 times. This helped pay off $100,000 in small business loans within 2 years. With a strategic marketing focus, debt repayment is more achievable.

Building an Emergency Fund Alongside Debt Repayment

As part of overcoming debt, it’s wise to build an emergency fund alongside aggressive loan repayment plans. 40% of small businesses lack adequate cash reserves, causing significant struggles when unexpected expenses arise.

Having even a basic emergency fund enhances resilience and the likelihood of survival in times of crisis. Experts recommend setting aside at least 3-6 months’ worth of operating expenses.

Small businesses with emergency funds weather downturns 2.4 times better. So allocate a portion of your increased cash flow from debt repayment strategies to build financial reserves. Automate monthly transfers so this becomes an ingrained habit, not an afterthought.

The goal isn’t a large sum immediately. Even $500-1000 initially makes a difference, building gradually till you have adequate backup capital. Emergency funds give small businesses the capacity to overcome hurdles without sinking back into debt cycles.

Getting Professional Financial Advice

If debt management becomes complex or overwhelming, don’t hesitate to seek professional financial advice for small businesses.

Financial advisors and debt management firms can provide personalized guidance taking into account your unique situation. This includes:

- Customized debt relief or consolidation plans

- Negotiating with creditors

- Navigating bankruptcy if required

- Preventing damage to your business credit

While fees may apply, the investment is often worthwhile to overcome hurdles hindering business growth.

Staying on Top of Finances

In tandem with addressing current debt, it’s equally important to implement good financial practices and safeguards to avoid spiraling back into debt.

- Institute detailed budgeting to optimize cash flow allocation.

- Perform regular financial reviews to identify issues early.

- Limit the use of high-interest financing options.

- Maintain adequate savings to cover emergencies without taking on bad debt.

With discipline and a long-term small business growth mindset that prioritizes stability, you can break the debt cycle and build lasting prosperity.

Key Takeaways on Overcoming Small Business Debt

- Assess your current debt portfolio completely to understand what you’re facing.

- Restructure terms with creditors to create a manageable repayment plan.

- Boost income streams and lower costs to increase cash flow for debt repayment.

- Leverage government and non-profit assistance programs for support.

- Create a repayment strategy and timeline that optimizes interest savings.

- Seek professional guidance if you feel overwhelmed.

- Institute good financial practices to avoid the recurrence of debt pitfalls.

With focus and commitment, small business owners can overcome debt hurdles and redirect their energy toward growth-oriented pursuits. Don’t allow debt to keep your business stuck. Take back control with strategic debt management.

Frequently Asked Questions

How much debt is too much for a small business?

There’s no universal threshold for determining how much debt is manageable. It depends on cash flow, profit margins, and the business model. As a general rule, if debt repayments exceed 10-15% of revenue or 50% of profits, it could be time to re-evaluate.

Should I take out a loan to repay existing debt?

Not necessarily. Taking on expensive new debt can worsen your situation. First, try restructuring existing debt. If that’s insufficient, assess if new financing makes sense based on terms, eligibility, and long-term impact.

What are the risks of debt restructuring?

It can temporarily impact your business credit score if not managed properly. Be strategic when negotiating terms and time repayment diligently to mitigate risks. The long-term gains of structured payments often outweigh temporary credit score drops.

How long does it take to repair business credit after debt problems?

It varies case by case, but with diligent repayment and financial prudence, your score can begin improving in 6 months. Full recovery can take 1-2 years. Seek expert guidance for the fastest path to credit health.

Should I use the debt snowball or avalanche method?

Choose based on your priorities. The snowball method provides quick wins for motivation. The avalanche method optimizes interest savings. Assess which aligns best with your business goals and cash flow capabilities.

What are the common hidden costs of restructuring debt?

Potential costs include prepayment penalties, refinancing fees, balloon payments, higher long-term interest, and negatively amortized loans. Read terms closely and seek professional advice to avoid pitfalls.

What financial ratios indicate my business has a debt problem?

Key ratios to watch are debt-to-equity ratio, debt-to-assets ratio, times interest earned ratio, and debt service coverage ratio. If any exceed thresholds for your industry, it likely signifies excessive debt burden.

Can I cut staff to reduce costs when tackling debt?

This option can backfire long-term by impacting morale and productivity. First, optimize operations for efficiency and cost reduction. Only downsize strategically as a last resort, if necessary.

What are alternatives to bank loans for debt relief?

Options like credit unions, online lenders, SBA loans, crowdfunding, grants, and microloans often provide affordable financing for small businesses managing debt.

How can I avoid business debt problems in the future?

Institute budgeting, maintain emergency reserves, limit high-interest debt, review financials regularly, create realistic growth projections, optimize accounts receivable, and keep debt service below 10-15% of revenue.

What are signs my debt load is hurting business growth?

Indicators include constantly putting out financial fires, struggling to pay vendors/staff on time, inability to fund opportunities or inventory, profit stagnation, and diversion of resources towards interest payments.

Should you refinance small business debt?

Refinancing can make sense to secure a lower interest rate or consolidate multiple debts. But fees, eligibility issues, and extended repayment timelines carry risks. Carefully analyze if potential savings exceed refinancing costs and fit your business financials before proceeding. Consult experts to determine if it is suitable for your situation.