People nowadays are getting used to the convenience that online payments and the use credit or debit cards have to offer. These digital payment methods have become the more preferred way of settling most of our personal or business bills. However, despite the many advantages of these easy payment methods, the traditional approach of paying our bills with the use of checkbooks and check ledgers is still beneficial in many ways.

Having full control of your finances

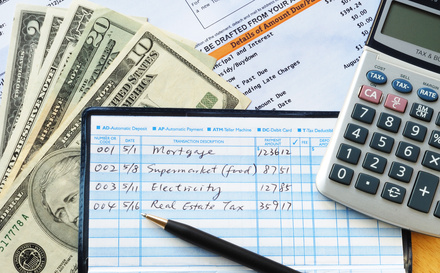

Having a checkbook and check ledger allow you to have a full control of your finances. With checks, you can easily track your available bank balances in your checking account which lessen the risk of overdrafting. It’s a great tool that record to where your last cent ends up.

Accessibility is a key element

Credit cards were created as a means of convenience but it’s unbelievable just how much convenient a checkbook can actually be. Keeping a check ledger allows you to monitor your remaining balances while systems are down for maintenance or offline. You just have to write a check if you are in need of money and have it cashed thru banks. Some businesses prefer cash and using credit card to make cash advances in ATM machines will charge you with extra fees.

Immediately assess your cash flow

When you do all you finances online you may have a hard time to reconcile your cash flow especially if it doesn’t record your transactions automatically. With written check and expenses you can easily monitor and immediately assess your finances including those cash-in and cash-out transactions made thru different ATM machines. This can be an invaluable perk when it comes to calculating numbers regarding your finances that you just can’t afford to risk.

These are some of the advantages of using checkbooks and check ledgers. Should you be interested to get a nice looking checkbook holder that carry your check with style, order at https://www.ibricraft.com. Give it a try and who knows, it might just be your thing.