Things to consider when you want to start your business in Japan as a non-Japanese

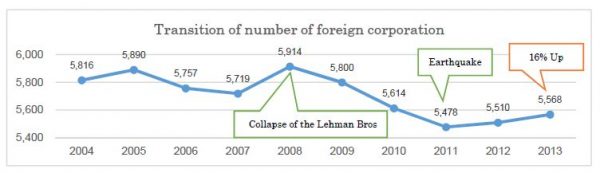

Even after the big earthquake that struck Japan in 2011, the number of non-Japanese companies in Japan continues to increase. When the National Tax Agency JAPAN released their annual report for 2015, it showed that after 2011, the number of foreign corporations has increased by 16% in two years.

There are many reasons to open business in Japan. As many expats living in Japan say, the most attractive point for them to settle in Japan is the feeling of safety. Especially for women and those who have children, they say it is the best part since they don’t need to worry when roaming around. Also, the public transportation system such as trains and subways, especially in Tokyo area provide you easy access from town to town with inexpensive transportation fees and safety.

For those who are willing to start up their business in Japan, there must be more than safety and convenience of transportation there.

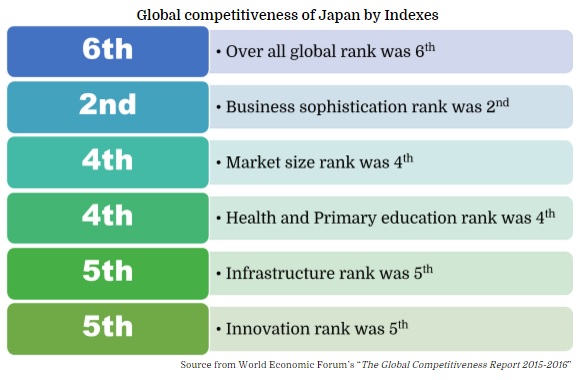

The report from “World Economic Forum” reveals that in terms of global competitiveness, Japan is ranked 6th in the world. It is the 2nd highest ranked among Asian countries.

If global market is your target, Japan’s ‘Business sophistication rank’ and ‘Market size rank’ of Japan may not seem interesting, but for sure it is very inspiring to get more ideas for your business. Even world famous unique tech creators like Apple Inc. is willing to move their research and development center in Yokohama, Japan (based on the article from The Wall Street Journal Japan, released on March 26, 2015). That tells you something, right?

Starting Up Your Business in Japan

To start up your business in Japan, there are many things to be considered. First, you should know the system of Japanese laws and regulations regarding the establishment of a company.

1. Incorporated

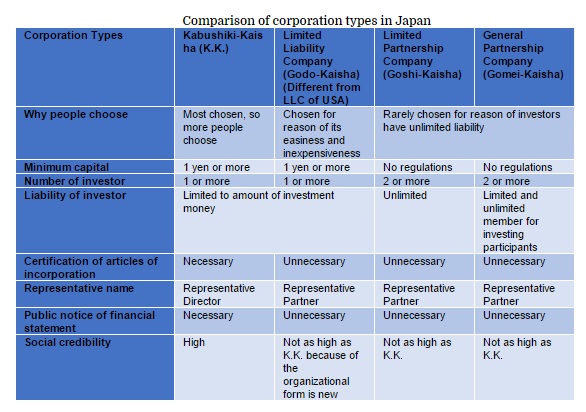

There’s four types of corporation in Japan. Weigh the advantages and disadvantages by looking through the comparison table.

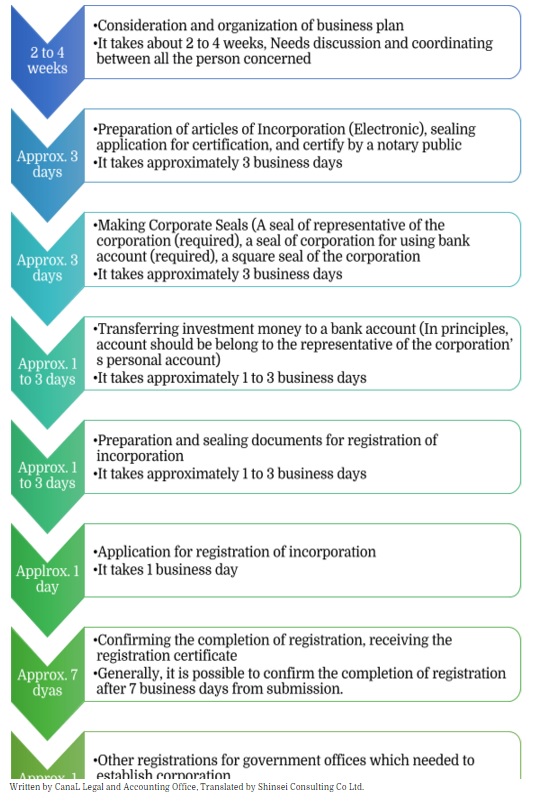

Example of establishing small K.K. procedures and how many days it will take for each process. Office space is a consideration, as you will need to list your Japanese business address on your company registration papers. Services like MailMate will provide you with a virtual address in Japan so that you can keep costs low.

2. Visa, Residence and Tax

If you want to live in Japan and become a director or a partner at your own company, there will be a big issue of acquiring Investor/Business Manager Visa.

Although, you don’t have to live in Japan to open your business in Japan. There’s three ways to do it.

Representative office: The establishment of representative offices doesn’t require registration, but they cannot open bank accounts by the name.

Branch office: Having branch in Japan requires registration.

Subsidiary company: The procedures and conditions of establishing a subsidiary company is as same as establishing a Japanese company.

If you can find a Japanese company to establish Joint Venture, that could also be an alternative.

Taxation is also an important thing to consider when choosing the type of company you are establishing.

3. Human Resource

If you are willing to hire someone, the government will require you to do things for the workers you are going to hire, but will also support you with recruitment.

Laws and Regulations

The Japan has laws regarding the protection of workers such as minimum standards on working conditions and minimum wage. The laws apply to all companies in Japan, regardless of whether the worker and the company is Japanese or non-Japanese.

Recruitment

If you are looking for Japanese workers, there are government-run employment agencies called “Hello Work”. They have offices throughout Japan. They provide both employers and employees with support of matchmaking for free.

Social Security System/Insurance

Everybody residing in Japan is part of the Japan insurance system such as the public health insurance and pension insurance.

There are four different kinds of insurance systems that companies are obliged to take part in.

- Worker’s Accident Compensation Insurance

- Employment Insurance

- Health Insurance and Nursing Care Insurance

- Employee’s Pension Insurance

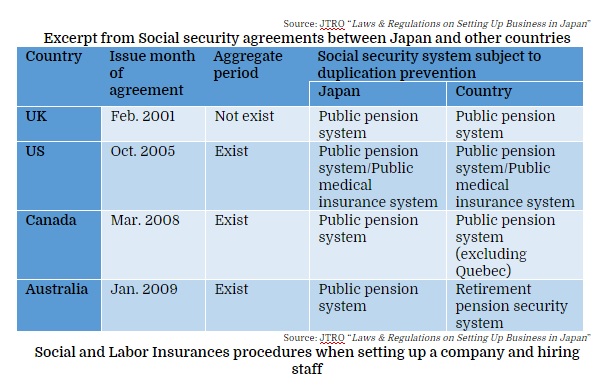

To avoid double insurance, there are agreements that have been signed between countries.

Excerpt from Social security agreements between Japan and other countries

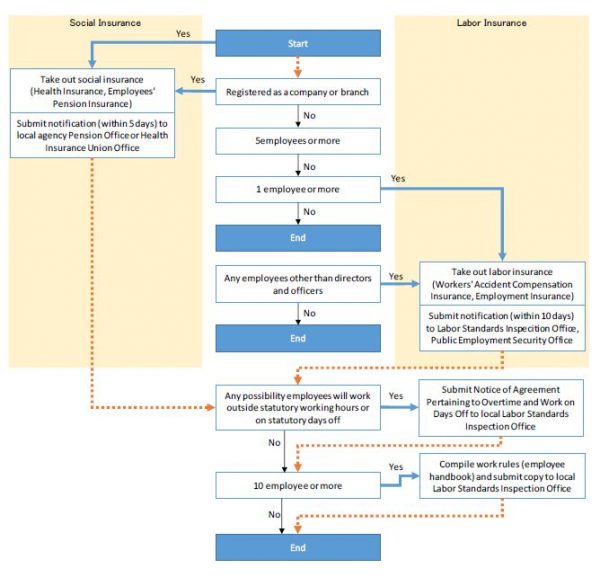

Social and Labor insurance procedures when setting up a company and hiring staff

4. Finding a partner

Finding a good partner is very important. If you can find a tax and accounting firm that is knowledgeable about both Japanese and international business and taxation as your partner/consultant, you can concentrate on your business without worries.

On next article, we are going to tell you about taxation related with foreign company or foreigner, and the trend on taxation in borderless age.