The end goal of every entrepreneur is financial profit. While successful entrepreneurs each have their principles they live by, there’s a common denominator for all of them – they’ve developed long-term habits that contribute to their main goal, one of those habits is being frugal.

It might sound absurd for successful entrepreneurs to be penny-pinchers, but that’s one trick they practice to remain wealthy. The exact point of Thomas Stanley and William Danko who said: “frugality is the cornerstone of building wealth”.

And as billionaire Warren Buffet puts it, “do not save what is left after spending, but spend what is left after saving”, showing frugality is no laughing matter.

If you’re a budding entrepreneur or even a long-time one, the frugal living tips we’ve listed here will definitely help with your financial profit goals.

Read on if you’re interested in knowing what those are, just continue scrolling down to find out.

1. Have a Savings Mindset

Saving is vital for a sustainable financial lifestyle. As a rough rule, you should have at least 6 month’s worth of earnings saved.

The purpose for this is that you’ll have some money stored when there’s an economic downturn. You’ll be able to keep yourself and your family sheltered and fed while you sort things out with the business or start another venture.

These unexpected events won’t be much of a setback if you have money stored away for the rainy days.

Following Warren Buffet’s words, you should put away the amount you save first before you spend it on other things.

Many entrepreneurs follow the 80:20 rule where they save up 20% of what they make every month. To make this happen, here’s a ballpark budget allocation you can follow:

- Keep the housing budget at 25% or lower of what you make whether you rent or own a house

- Leisure and entertainment, which includes going shopping, watching movies, and going to bars should only be limited to 10% of what you earn.

- Only 5% of what you make should go to car loans.

Warren Buffet takes it to the next level. He still lives in the house he bought for $31,500 back in 1958.

Other than those 3, you should also:

- Avoid risking your money on get-rich-quick schemes.

- Avoid amassing credit card debt. If you are, you have to re-evaluate your lifestyle.

- Find ways to reduce business cost-efficiently

2. Organize Your Spending, Track Expenses

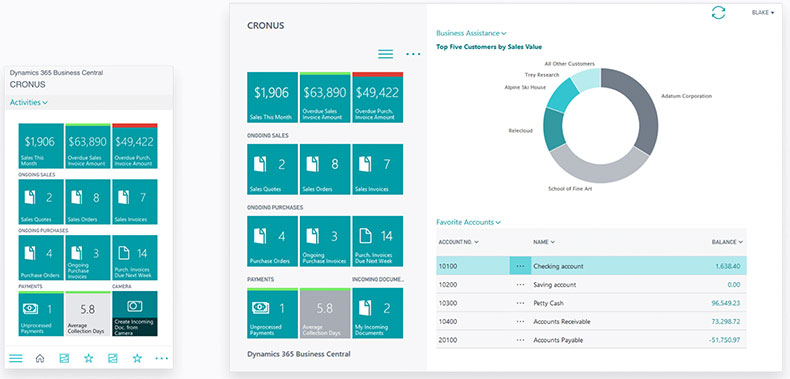

The only way you’ll know you’re progressing in making frugality a habit is when you track and organize your expenses. If you have recurring bills like insurance premiums, mortgages, or insurance premiums on top of utility bills, you should take note of the amounts you’re paying monthly in a spreadsheet.

This will give you a good idea of how much you’re spending, how much you can save, and what to prioritize every month. If you’re going to follow the 80:20, having a spreadsheet to look at will make it easier to see where you can make adjustments to increase your savings.

Your business transactions are likely to be more complicated than your personal and household expenses. There will be a lot of things to juggle.

My favorite example of this is the food industry. You’ll be dealing with sales, inventory, ingredient purchases, and shipments among others.

To organize everything and track your expenses you’ll need a food ERP system.

Investing in this system will save you time and increase customer satisfaction with your fast and efficient services. You’ll be able to make what you spent on this system in no time.

3. Utilize Vouchers, Coupons, and Free Offers

Frugality means you exhaust all possible means to save money, like by using vouchers, coupons, and also shopping on sales.

I mean, it’s like free money. You just have to go and grab it for yourself, or in this case, go and enter the discount code or the items on the sale menu.

One of my favorite brands when shopping is 3wishes. They have lingerie, clothes, swimwear, even shoes and boots on sale.

Did you know rich celebrities like Lady Gaga and Carrie Underwood love using coupons? Yes, they have all the money they can spend, but they choose to increase the value of their money by utilizing coupons.

In fact, American households that have an average income of $100,000 or are more avid coupon users than those who have an average income of $35,000 or less.

There’s no shame in using vouchers, rather it’s a wise practice to make more out of your money.

After all, you invested time and effort to earn that money, you have to make the most out of it.

There are free offers too for services you’d normally pay upfront for. My case in point here will be when you need legal assistance in case of a car accident, Price Benowitz LLC offers a free consultation and so with PaperStreet if you need law firm marketing assistance.

Granted, you might want to splurge from time to time as a way to reward yourself. But it doesn’t mean you have to spend on unnecessary luxury items.

Back to Warren Buffet, when he decided to donate his 2006 Cadillac DTS, he opted to buy a 2014 Cadillac XTS worth $40,000-$60,000 instead of getting an Aston Martin Valkyrie or Bugatti Diva that is worth millions.

Rather than spending it on luxury items, it’s much wiser to invest in educating yourself for financial growth. If you’re not a native English speaker and you have constant negotiations with English-speaking investors and partners, invest in a business English course.

Investing in education will get you in line to practice what successful entrepreneurs do to succeed and make the most out of their businesses.

Plus, by learning to speak their language, you can connect to them at a deeper level, making less room for miscommunication and in turn will result in stronger business relationships.

4. Choose Quality Over Quantity

Frugality doesn’t mean you never spend on anything you want at all. It just means you avoid the unnecessary, lavish, and extravagant, just like Warren Buffet when he opted for an economical car rather than a luxury car.

You’ll have to spend on expensive stuff for your home or business, but the quality of what you buy should always justify the price.

As an entrepreneur, you’ll have to invest in equipment to manufacture your product or systems to automate your services. You’ll have to look into long-serving quality equipment, and most often than not, it comes with a hefty price tag.

But just like the ERP software we talked about earlier, this automation will make the business more efficient leading to more satisfied clients who’ll come back again and again to do business with you.

If you’re doing business online, whether you’re offering products or services, you’ll need web hosting which HostGator and BlueHost are top choices. You’ll also need top-performing online shopping platforms like Wix or Shopify, a web designer, and a predictive dialer for cold calls.

Cybersecurity is also a common concern. Investing in a cybersecurity system or service is a wise move to protect your data and those of your customers.

The last thing you want to happen is for sensitive information to get into the wrong hands. They can either steal your identity or worse, sweep your bank accounts and those of clients empty.

Still, it’ll be a worthy buy. You’ll be saving on repairs, replacements, huge debt, and lawsuits in the long run.

5. Visualize Your Goals

Successful entrepreneurs have goals, not just plans. But what’s the difference?

Goals have the end result in mind regardless of the challenges along the way, you’re committed to reaching goals.

Plans, on the other hand, are a list of steps. When things don’t go as planned, you’re more likely to abandon the course you’re taking.

So visualize your marketing goals, visualize what a frugal lifestyle can do for your business. When you do so, there are fewer chances for external forces like setbacks to stop you from getting what you envisioned.

Having it clear in your head is like a constant reminder for you why you’re doing what you’re doing.

6. Be Proactive

Take control of the situation. As an entrepreneur, you’ll need to juggle a lot of responsibilities in the business. Even if you delegate the work to your subordinates, you still need to cause things to happen rather than just responding when a situation arises.

Take charge of your daily interactions, your financial obligations, your spending budget, your business production. You have to be on top of things to make your goals into reality.

Nowadays, there’s a large growth in growing a business online. Be proactive and learn how this modern way of doing business works by enrolling in a digital marketing course and learning how you can grow brand recognition sustainably using SEO.

Being proactive also entails verbalizing your financial goals to people around you. Your workforce has to understand your goals and what benefit that brings them. You can direct your HR team to help you with a goal assessment survey or organize online conferences.

Your friends and family need to know you’re shifting to a more economical lifestyle to help your business grow.

When you’re firm with your objective, your workforce will work with goals and your loved ones won’t pressure you to spend on unnecessary stuff.

7. Remind Yourself Why You’re Being Frugal

This is somehow related to point 5, these 2 points work hand in hand. But here, there’s more emphasis on keeping the“whys” clear in your mind.

Constantly reminding yourself why you’re being frugal is a powerful motivator to keep going. It’s what will fuel you to make the effort even if it requires some sacrifices on your part.

Additionally, when you have the reasons why you’re being frugal planted in your mind, it’ll be easier to envision your goals.

Take for example if you have an online business you want to grow and you constantly remind yourself of that. Learning how to value an online business and see its progress by gauging how much your business is worth, will reinforce your commitment to be frugal.

Reminding yourself why you’re being frugal also helps you acknowledge how this can impact your finances. You’ll be more aware of how your spending habits can help or hinder your financial growth.

It’ll also motivate you to find extra ways to make money to compensate for buying something that’s not necessary.

Keep in mind that being frugal shouldn’t just be a phase, just for the period where you need to save enough for something you need. It should be a way of life.

You’ll be amazed at how much difference being frugal can make in your life.

8. Curb The Impulse, Practice Self-Discipline

It won’t be easy, especially so because it’s impossible to isolate yourself from the temptations around.

You can’t control what you’ll see, but you can control your eyes to linger on it or not. Take a conscious effort to avoid these temptations.

If you easily get engrossed with luxury cars, vacations, and top-of-the-line gadgets, learn to curb your desire to spend on these.

One thing that can help is by getting a counter-thought ready. It’s what you’ll focus your mind on when a temptation to buy something arises.

If you’re tempted to buy a newly released gadget, you can counter the desire by reminding yourself your current one still serves the purpose you need it to or by looking at your monthly bills.

Also, be aware of how your desire can be. If you know it’s hard to resist, then you can act accordingly by avoiding places, websites, and TV shows that will get you tempted.

Do it until the pull gets weaker and weaker, then you don’t have to struggle so much.

Humility and modesty will also help. It’ll remind you that you don’t need a $2,000 suit when you only have to wear it once.

Many people live beyond their means to impress others, to get to a social status they think they deserve. They end up spending on stuff to impress people they don’t even like.

However, if you have the humility to accept what you can only afford, being frugal will be so much easier.

Curb the impulse to be overly proud of yourself. You’ll be the one to suffer in the long run when you drown in credit card debt.

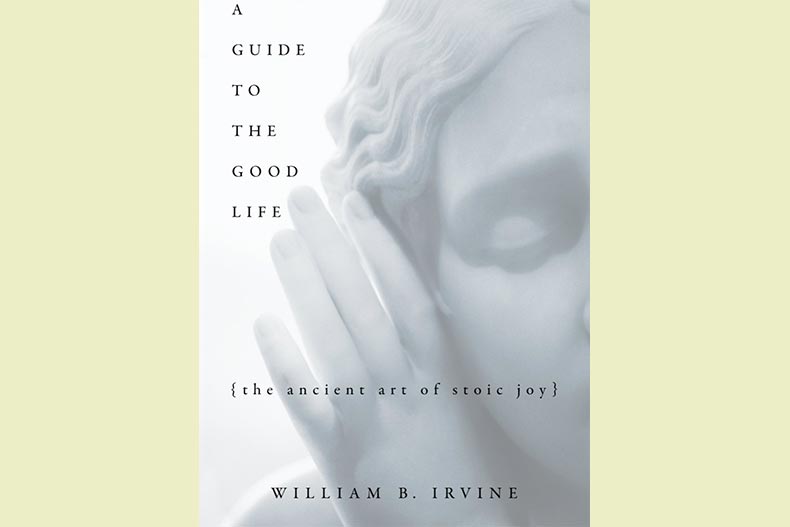

A book titled “A Guide to the Good Life: The Ancient Art of Stoic Joy” by William B. Irvine reveals a secret of Stoics. That they were able to live a frugal life because they are indifferent to what others think.

Live as the Stoics do, then you’ll have the self-control to be frugal. You’ll be able to do what others can only imagine and be able to refrain from what others always give in to.

And even when you’re still working on achieving your goals, you’ll be happy and content even at this point.

9. Learn To Cook

This is a practical point you can follow. Learning to cook is a tried-and-tested trick to save money. Instead of spending on expensive meals made by others twice or even thrice a day, cook the food you eat yourself.

You’ll be less reliant on restaurants and food deliveries plus, you can whip up anything you like to eat in a jiffy.

You can even treat your loved ones to a hearty homemade meal.

10. Remember To Be Realistic

You don’t have to be an ascetic and deprive yourself of everything you want while saving up for your business growth. After all, your goal of making money is to make you happy.

Realistically, you can’t absolutely prevent yourself from buying some things that you like, and there’s nothing wrong with that. Reward yourself once in a while, but don’t forget about the bigger reward you’ll get once you save up enough money.

Final Thoughts

You may feel discouraged when you feel you can’t be completely frugal when you have some random splurges now and then. Again, be realistic, learning to be frugal doesn’t happen overnight.

From time to time you’ll stumble but don’t stay on the ground, visualize your goals and remind yourself why you’re going frugal so you’ll be motivated to push harder.

Be proactive and keep on finding ways to save up on your personal and business expenses. Get your employees, friends, and family in the same boat you’re in so it’ll be easier for you to reach your goals.

When you run a race, you’ll rarely see the finish line when you just started running, just keep on moving further. Don’t let minor setbacks hinder you from achieving your ultimate goals.

But in the end, don’t let frugality drive you into misery. Strike the balance between being frugal and investing in yourself and your happiness. After all, you want to make money to be happy.

When you do so, you’ll make your entrepreneurial journey worthwhile and exciting.