There are still some bank clients that would feel more comfortable in doing banking transactions the traditional way -visiting the bank’s branch and talking to bank representatives. Whatever you need, you know that someone in the branch will be able to assist you. And that you won’t be required to suddenly learn any technical terms just to get that help. This sense of comfort is precisely what keeps many customers visiting bank branches instead of taking their banking online. But the truth there is that digital banking or online banking (as commonly known) isn’t that intimidating or too technical as most of us think. In fact, online banking is one of the best innovations and developments in the financial industry. Not only that it gives convenience to customers but it saves time for the busy ones. It enables everyone to transact some of their banking needs online such as funds transfer, bills payment, inquiry of bank balances, and a lot more at the mercy of our fingertips.

What is digital banking?

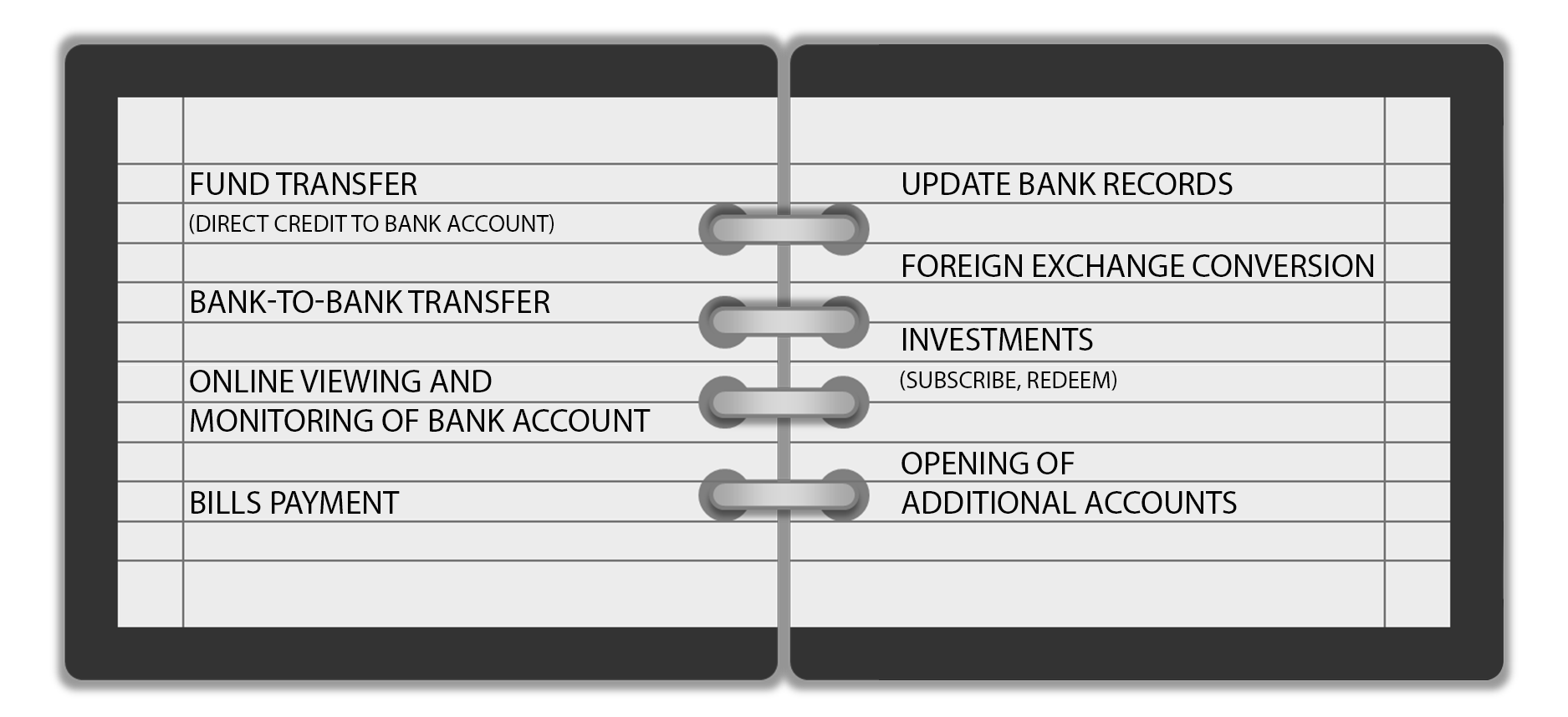

Digital Banking refers to the digitization or a step towards online of all the major traditional banking programs and activities, that were used to conduct by the customers by the physically presence within the premises of respective banks. Let’s have a look at the activities that can be performed by the digital banking model:

➢ Money withdrawals, deposits, and transfers.

➢ Saving and checking account management.

➢ Analyzing various financial products.

➢ Bill payments.

➢ Loan Management.

➢ Account services.

The above services are just a few of the transactions being offered in the banking business models. More banks are continuously upgrading their system not just to keep abreast with the fast changing technology but also reaching out to their customers in a faster and easier way.

Online banking isn’t that new rather, it’s into the fashion from 1994 and is limited to a few banks in the US. If you study more on its history, you will learn that Microsoft Money and the Standard Credit Union were the first banks that were able to afford the digital banking in earlier years. And with the time, others also looked into the same and tried to implement on their platforms as well.

Initially, the options were less, but with the advent of technology, the things have moved with rapid pace and people started adopting, due to the benefits it brought to its users. If you are one of those who want to synchronize your bank accounts through your phone, then undoubtedly the digital banking is what suits for you. So, get a control of everything in your hands, and start to manage your finances effectively.

Go ahead and grab online banking applications on your mobile now and experience the hassle-free benefits it can bring.