The Bullish Perspective on the Snap IPO

From a bullish perspective, anyone who invested in the company, or was there from the get go enjoyed windfall gains. In fact, the numbers speak volumes: Employees of the company were 50% better off on Thursday than they were on Wednesday. Naturally, a bullish market is the best place to showcase a newly launched company, and Wall Street is plenty bullish at this time. Recall that the Dow Jones Industrial Average is trading near record highs of 21,000, while the NASDAQ and the S&P 500 index are close in tow. The underwriters of the Snap IPO are thrilled, and the upside potential knows no bounds. Remember that there is a mandatory lockup timeframe. During this time, it will not be possible for company insiders to sell their stock to capitalize off the pop.

The Bearish Perspective on the Snap IPO

The price generated for the Snap IPO was purportedly undervalued. In other words, the stock sold for a lot less than it should have. Estimates suggest that the stock could have gained $1.1 billion more had it been priced correctly. The beneficiaries of the Snap IPO were the investment banks and their institutional clients who generated returns of 50% + and will later reimburse the banks in the form of additional business, or fees. This is the nature of Wall Street and it is also the reason many IPOs performed sub-optimally. While the big banks made most of the cash on Thursday, 2 March, investors, employees, and executives from Snapchat also enjoyed strong returns. Perhaps it’s worth discussing how the price setting mechanism works with an IPO such as Snap Inc. An ongoing series of negotiating rounds is conducted between the underwriter, the investors and the company, in this case Snapchat Incorporated.

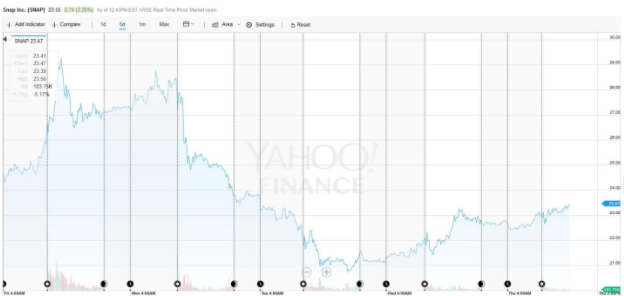

These vested interests all attempt to set the best possible price by balancing out aggregate demand and aggregate supply. Of all the IPOs between 1988 and 1995, 12% of them generated first day returns of 30% +, while 25% of companies listing IPOs during that time recorded losses below their offer price. The volatility that characterizes stocks post-IPO is well documented. There is no doubt that many stocks pop and then drop in the days and weeks following the IPO, Chick-fil-A being one of them. The interest in the Snapchat IPO was immense, given the huge volume of trading activity in the market, as evidenced by CFD/Forex in the Snap Scenario. The more pertinent question is how to trade the stock moving forward.

Analysts Not Optimistic about Prospects for Snap Inc.

Already, we know that the company has a market capitalization of $26.95 billion, but there are now rumors swirling about that this is a bad stock to hold. Various analysts have called it an underperform stock (Needham), a hold stock (Susquehanna) or a sell stock (Nomura and Pivotal Research). As an investor, it’s important to ride out these volatile trading sessions, and wait for the stock to settle into a comfortable trading range. It hardly ever pays to jump on the bandwagon from the get go, given the extreme volatility that is likely to follow. A slow and graduated approach to investing is probably best in this regard. If Wall Street undergoes a reversal (via a correction), tech stocks like Snap Inc are often the first to take a hit. From a trading perspective, put options following the massive net-call option volume. It’s still early days and we will have to wait for the equilibrium to be established.