Do you feel there are only a few US expat tax resources you can read to learn more about the subject?

If you answered “Yes,” then I’m happy that you’re here.

Filing your US expat tax returns can undoubtedly be a maze if you don’t know the best references to aid your study — much less if you had zero idea about the subject to begin with.

Since you’re living outside the country, it may be painfully inconvenient for you to consult an IRS officer long-distance or read local US expat tax briefers at the IRS building.

Thankfully, there are a handful of valuable online materials to help you grasp the ins and outs of processing your taxes as an American expat.

That said, in this post, I will share with you X resources you need to read as a US expat taxpayer.

Are you ready?

Let’s jump in.

IRS Reference Materials

If you want to get the most reliable online references on US expat taxes, then the IRS website is the place to go.

Being the official authority on US expat taxes, IRS has a plethora of materials in written and multimedia formats available for your learning consumption.

Here are some of the expat tax resources you need to read from their website:

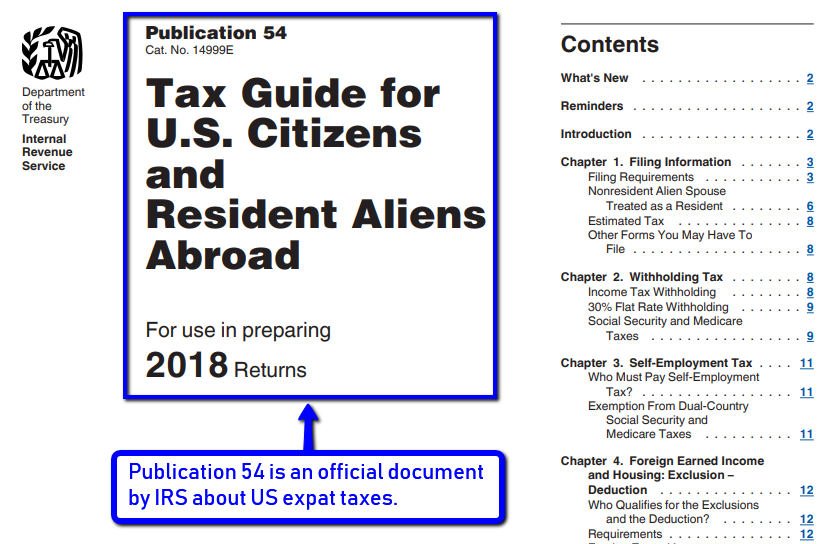

Publication 54

Publication 54 is the Tax Guide for US Citizens and Resident Aliens Abroad.

This document describes the various significant facets of paying your individual US expat tax returns — especially for 2018.

Publication 54 is helpful when you want an official and comprehensive reference material for government regulations on US expat taxes.

The material covers these topics:

- Filing information

- Withholding tax

- Self-employment tax

- Foreign Earned Income and Housing (exclusion and deduction)

- Exemptions, deductions, and credits

- Tax Treaty Benefits

- Assistance on your US expat tax

It indicates the right forms to submit, vital reminders, and updates on tax arrangements, such as on the unavailability of previously used documents for compliance.

You can, however, still access helpful content about the above matters from the IRS website (we’ll go through this in the next section) quickly.

Publication 54 is available on PDF and HTML format options to suit your reading preference.

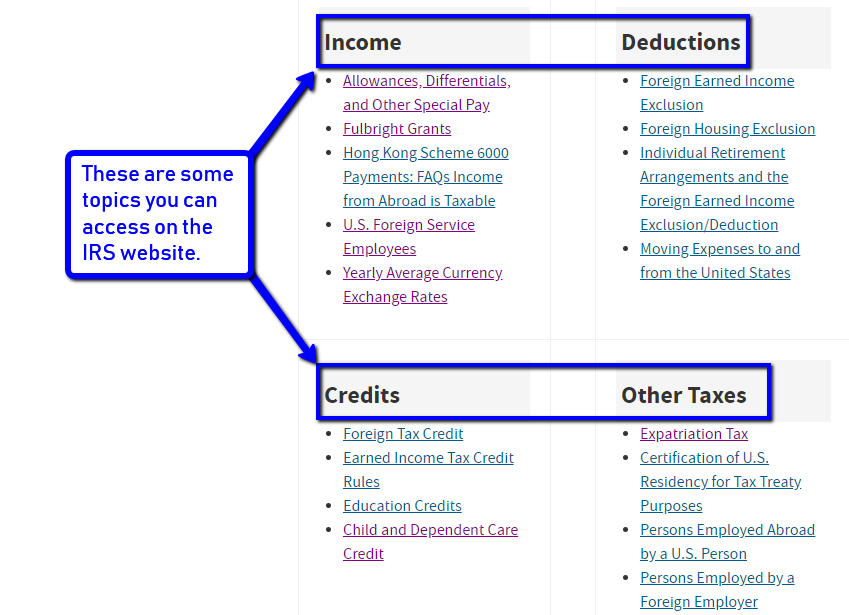

IRS Website

The IRS website is chock full of numerous other references to elaborate on how you process your individual and international business tax returns.

It allows you to access quickly a particular list of topics concerning significant aspects of your US expat tax payment.

These include your filing requirements, US residency status, income, deductions, credits, forms, other taxes, and even electronic filing (or e-file).

Each section then has links to more specific concerns.

For instance, under Filing Requirements, you’ll find Tax Information for US Armed Forces and US Government Civilian Employees Stationed Abroad.

IRS also gives you guidelines on Foreign Earned Income Exclusions (FEIE), which are valuable if you want tax exclusion benefits, and submitting your Foreign Bank Account Report (FBAR) if you opened bank accounts abroad.

The IRS website library makes it convenient for you to find the right details for your concerns and even connected references to a topic.

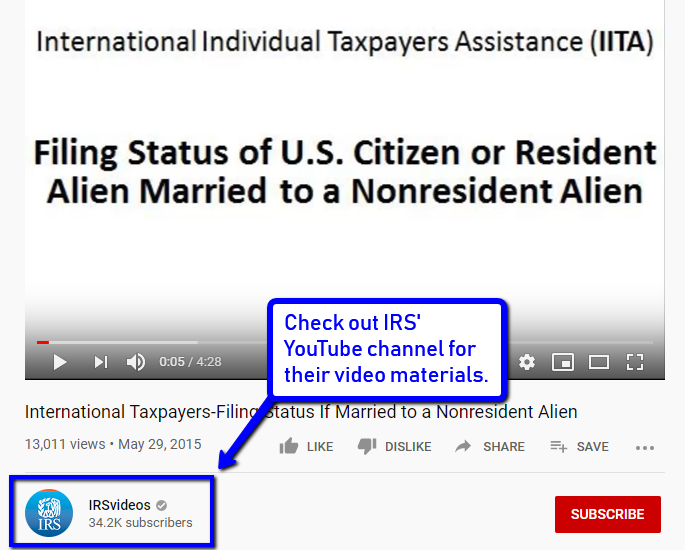

Videos

IRS created these videos to aid you in understanding US expat tax payment process better:

- Intro to International Taxpayers.

- Individual Taxpayer Identification Number (ITIN)

- Filing Status if Married to a Nonresident Alien

- Foreign Earned Income Exclusion

- Foreign Tax Credit.

These videos teach you what these provisions mean for you, including conditional requirements and situational examples.

They show you how to navigate the IRS website when processing these requirements, what details you should write or enter in the appropriate forms, and more.

IRS posts these videos on YouTube using its verified channel, IRSvideos.

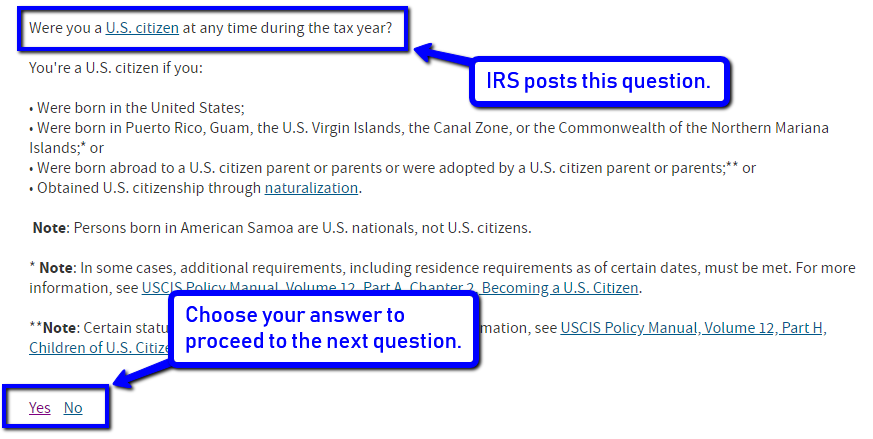

Interactive Tools

If you want a more engaging way to answer some of your US expat tax questions, IRS has interactive online tools that you can use.

These interactive tools will lead you to a series of questions you have to answer in every step to get the right feedback.

One tool deals with your tax trails.

For example, you might be asking, “Am I required to file a US individual income tax return?”

Here’s how you use the tool to find IRS’ feedback to your query:

IRS asks the first question and requires you to click on either of the options. It provides links to references should you be unsure what your response should be.

IRS then leads you to the next questions until you receive its feedback to your query, along with explanations and supporting details.

IRS also has an Interactive Tax Assistance (ITA) to answer queries related to tax laws.

This tool informs you first about the kind of details that should be available with you when you begin to use it.

ITA is more time-oriented, so having the details ready will help you to use the tool more effectively and productively.

Books by Other Authors

International Tax and Business Guide 2018 (Reeves)

If you’re an entrepreneur looking to expand your business internationally, one of the things you should know relates to your foreign business taxes.

One book you can refer to is the 2018 edition of International Tax and Business Guide: Expert Legal Guide for American’s Living, Working, Investing and Doing Business Abroad by Christian Reeves.

It gives you the tools to help you expand your profits and reduce taxes while you work and reside overseas.

It guides you on the forms and reporting submissions, as well as the costs and risks of failing to comply with the requirements of international taxation.

It also mentions current matters such as cryptocurrency, Trump’s tax agenda, and residency programs.

U.S. Taxes for Worldly Americans (Wagner)

If you’re a US expat who loves traveling and staying in different foreign countries, then this book is for you.

In his book, US Taxes for Worldly Americans: The Traveling Expat’s Guide to Living, Working, and Tax Compliant Abroad (Updated for 2019), Wagner teaches you how you can lower your taxes significantly and legally while abroad.

As a Certified Public Accountant, US immigrant, expat and world traveler, Wagner shares techniques on residency, citizenship, and others that can help qualify you for foreign tax deductions, exemptions, and credits.

The book also contains a mine of US expat tax information that’s updated for 2019.

Expat Secrets (Thorup)

If you want to learn practical tips from someone with rich, first hand experience with living abroad, traveling, earning huge profits, and saving on taxes, then you need to read Mikkel Thorup’s book.

Expat Secrets: How To Pay Zero Taxes, Live Overseas & Make Giant Piles of Money fills you in on valuable knowledge so you can avoid years of trial and error with handling US expat taxes.

Garnered from Thorup’s trips to over 100 countries, timeless lessons fill his book, giving you a no-nonsense path to offshore marketing.

Reputable industry and business leaders — who are experienced expats themselves — highly recommend this book to anyone starting out in international tax.

Your Turn

US expat tax is a tricky topic, but online resources like the ones mentioned above help make learning more painless.

With these expat tax resource materials, you can begin to learn about the process particulars, including some nifty tax reduction techniques, and obtain a solid grasp on the subject.

Was this post profitable for you? Do share it with your friends and colleagues. Cheers!